If you really want to trade high probability forex trading setups as they are forming on your charts you really need two main thing (this is my opinion, others may have theirs and you don’t have to believe me):

And the next thing is: you need to know how to trade these setups.

In this post, I’ll share with you how to do that.

Here are these two things:

#1: Support and Resistance Levels

#2: Larger Timeframes (monthly, weekly, daily)

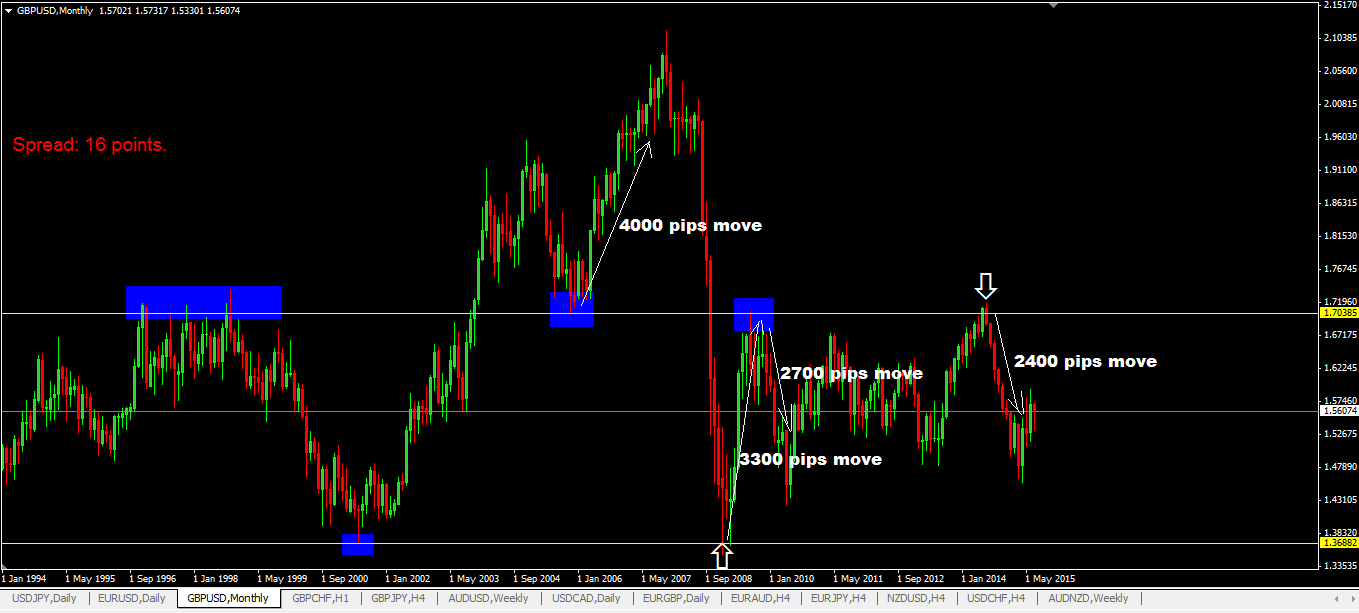

Now look at this monthly chart of GBPUSD below and notice how price has reacted to those price levels highlighted in blue boxes and alos notice how many pips price moved.

HERE’S HOW IT WORKS

The core of price action trading is support and resistance trading. Those support and resistance levels found in the larger timeframes are the initiators of the major trends that can last from days to weeks and many months and this causes price moves of thousands of pips.

- You should mark those support and resistance levels in the larger timeframes and make a mental note of how far away the price is away from those levels.

- This will give you a rough idea of how many months, or weeks or days before price is most likely to hit the level.

- If any price level is too far away, don’t bother to mark it but only those that that will most likely be hit 1-2 months time.

- you may be trading based on a trading system that uses the 15min or 1hr timeframe etc…but those lines drawn based on the setups in the larger timeframes are a constant reminder to you every time you check your chart. Out of sight=out of mind.

- and when price gets very near to those larger timeframe setups, you really need to sit up and take notice. Why? Because sometimes, a very well placed trade based on these larger timeframe setups can make you huge profits that exceeds what you’d normally make in 6 months or a year. The largest profitable trade I even made from such high probability trading setups was a 1600 pips move on GBPJPY and it took many weeks for it to happen and I got stopped out eventually. I’ve never broken that record yet.

- Now, you many not be lucky every time when you take a trade but when you begin to understand and see the thousands of pips the price moves when it hits these support and resistance levels, it does pay to pay attention to these types of setups, don’t you think?

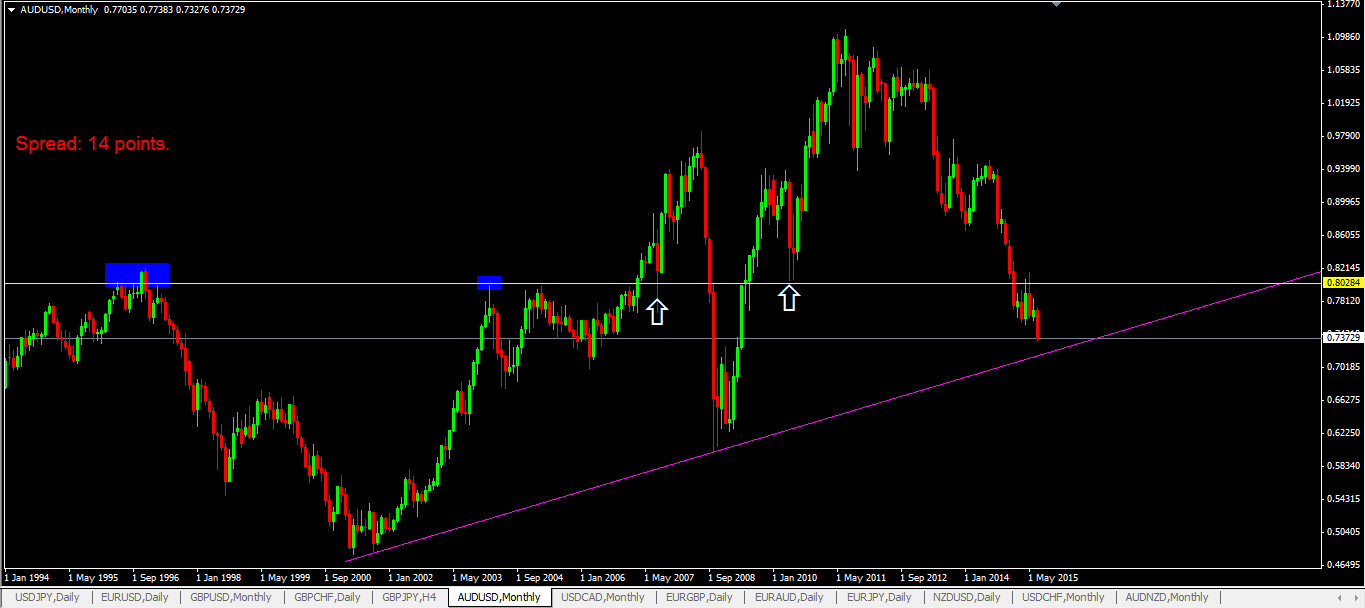

Notice how price reacted to resistance level turned support below and these are thousand pips move.

THE IMPORTANCE OF ANALYZING LARGER TIMEFRAMES

Why you should be analyzing larger timeframes is because of these two things:

- major trends are much more clear in the larger timeframes and

- because of that, there is less “noise”

But here’s the main problem with trading larger timeframes: you will wait for many many days, weeks and months and even years to trade these setups that form in these larger timeframes.

Now, who would wan’t that? You’ll most likely grow grey hairs just sitting behind your computer and watching.

So what’s the best way to trade these setups then? Continue reading to find what I think is the best way to trade these setups.

HOW TO TRADE HIGH PROBABILITY TRADING SETUPS FROM LARGER TIMEFRAMES

- You can be using trading strategies that trade in the smaller timeframes like 15min to 1hr or 4hr etc…that ok, but always take a step back and see what’s happening in the larger timeframes and be aware of what is happening there.

- then as price nears these areas of support and resistance levels in the larger timeframes, which may includes trendlines and channels, you need to get ready to buy or sell in the much smaller timeframes that you are trading in.

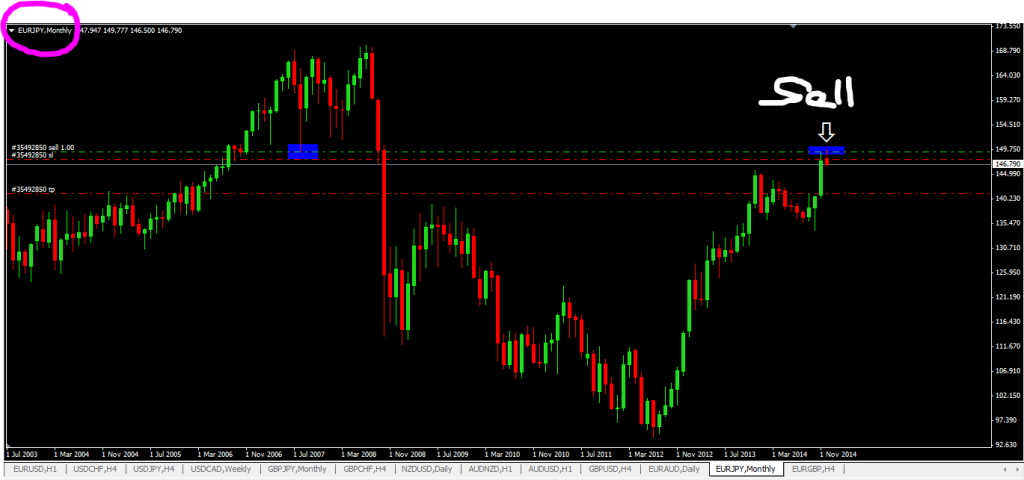

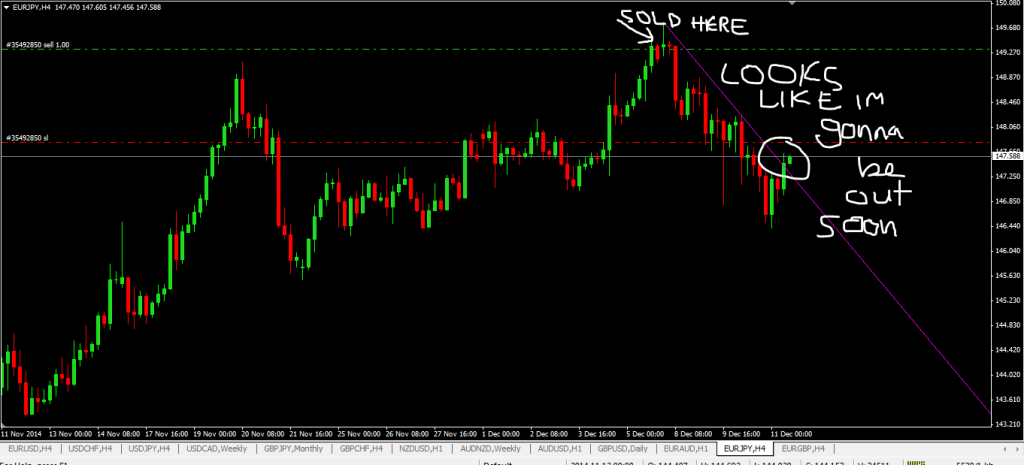

Let me give an example: I saw this sell setup forming on EURJPY on the monthly timeframe:

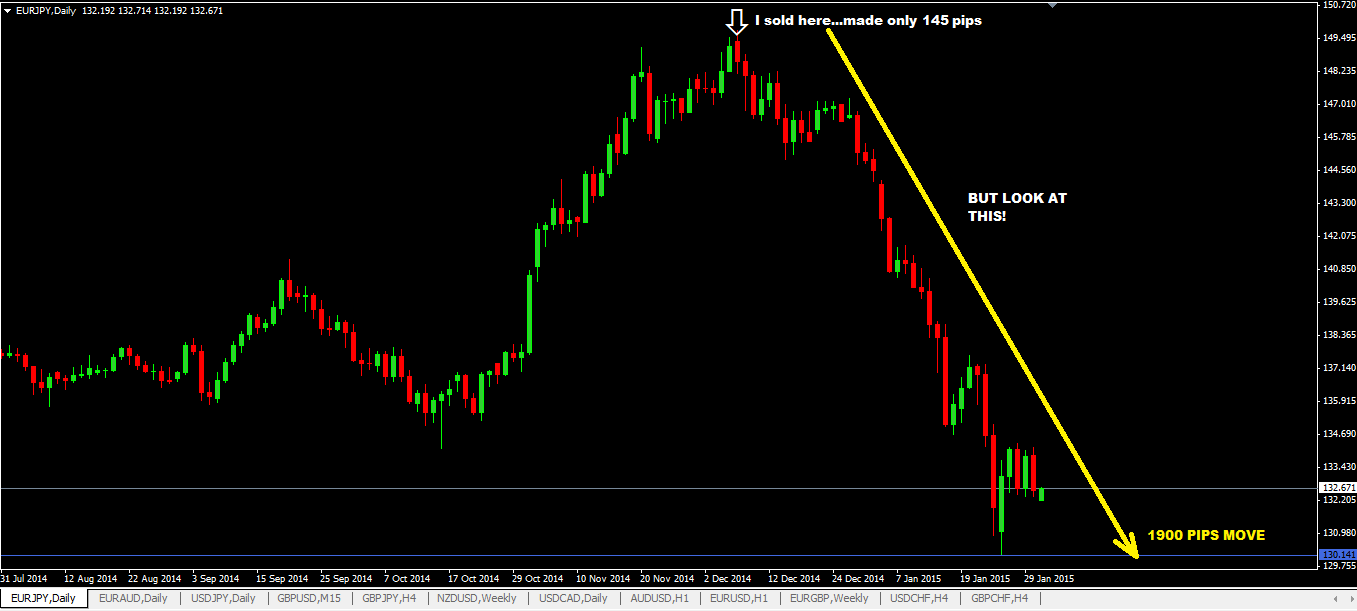

Notice the shooting star bearish reversal candlestick in the 4hr timeframe on the chart below? That was my sell signal in this zone or level of resistance to go short:

Even though my trade was short lived and made only 145 pips profit on this larger timeframe setup, what I’d like you to see is what happened next:

YOU MAY HAVE TO ENTER A TRADE MORE THAN ONCE ON THE SAME SETUP

Ok, there will be times when price may not necessarily reverse from those support and resistance levels. It can hit that level and reverse as expected only to go the opposite direction again.

So if you enter a trade on this first time when it hits a level, you may get stopped out.

And then you think, “that’s it, this level is broken and it won’t work!”

Hang on, its not usually over yet…

Just wait and watch to see how price reacts even after that major price level may looks like it has been broken. Usually its only a “price spike” that acts to shake many traders off and then finally it starts to obey the trading setup that was seen in the larger timeframe.

So that means, you may have to enter for the 2nd or third time by switching to smaller timeframes and use trading strategies like:

- 123 pattern trading strategy

- trendline trading strategy

- trendline breakout trading strategy or

- such trading systems like the floor traders method.

Just use a little bit of imagination by applying these strategies with reversal candlestick patterns when you have such situations like that.

HOW TO RIDE OUT THE TREND FOR MAXIM PROFIT EXTRACTION

Now, say you’ve entered a trade based on a high probability trading setup based on the larger timeframe. How do you make the most pips out of the the trend?

Answer: Ride it out until you get stopped out.

Here’s how.

Let say, you enter a sell trade on the 4hr timeframe after you see a bearish shooting star form on a resistance level that you’ve seen on the monthly timeframe.

Now to ride out the trend for maximum profit extraction, here’s what you need to do:

- make sure your stop loss must be placed far away as possible. Remember, you are trading setups based on the larger timeframes…so the stop loss must reflect this. Place 50-80 pips initial stop loss or the other technique would be to get the average true range of whatever currency pair you are trading and use the “1” day trading range as your stop loss.

- Now, to trail stop your trades, you need to use the daily timeframe to do it. Any timeframe less than the daily timeframe and that’s too much noise and you’ll most likely get stopped out too early. With the daily, you can ride out the trend as long as you can by using the lower swing highs to place your trailing stop loss behind them as price moves in favour for short (sell) trades and do the exact opposite for long (buy) trades.

Don’t forget to share and tweet this post to your friends by clicking those buttons below. Thanks

Posted in

Posted in

Good article and always gaining knowledge – thank you – Doug.