Trading Reversals – Powerful Moves

The Commodity Channel Index (CCI) is used to identify cycles in a market and for trading reversals. It is applied to trading in two opposing ways:

- Identify beginning of a long position when the CCI crosses above 100 and the beginning of a short position when it crosses below -100.

- Identify overbought or oversold markets when the CCI crosses above 100 or below -100.

We will present a trading reversals strategy that uses the second approach to identify overbought and oversold conditions and to indicate where to fade the market. This builds on the foundation of our Forex Swing Trading Strategy #9.

The simplest way to fade the market is to wait for the CCI to cross below 100 for shorts or above -100 for longs. This can work quite well but in strongly trending markets can also result in multiple failed trades. To reduce this risk we add the following conditions:

- Wait for the CCI to cross above 200 before entering a short setup or below -200 before entering a long setup.

- Place the entry for a short several pips below the low or for a long several pips above the high of the setup bar for additional confirmation of a reversal.

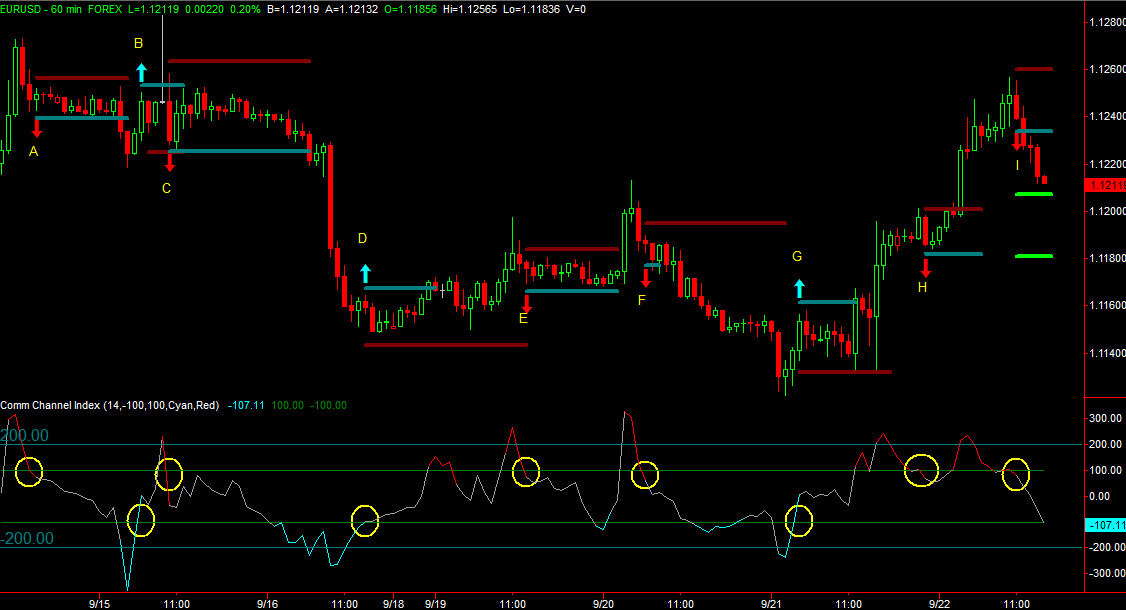

Figure 1 shows the strategy applied to a recent hourly chart on the EURUSD.

Figure 1

The yellow circles shows where the CCI had crossed the 200 level prior to crossing the 100 level, indicating a setup. The dark blue lines indicate the entry price and the dark red lines the initial stop. The entry is three pips above/below the setup bar and the stop is five pips below/above the setup bar. With this strategy we trade two positions. After price has moved in our favor by the amount of the initial risk we close out the first position and move the stop on the second position to breakeven. When price moves in our favor by two times the amount of the initial risk we close out the remaining position. Each of the letters on the price chart represents a separate setup. Below is what happened with each one:

- A: The short entry was hit 12 bars after the setup. It advanced an amount equal to 100% of initial risk and we exited the first position and moved the stop on the remaining position to breakeven where it stopped out soon after.

- B: The long entry was hit on the spike three bars after setup. It also booked a first position profit of 100% of initial risk and stopped out of the second position at breakeven.

- C: It took twenty bars before the short entry price triggered but only nine more bars to reach both the 100% and 200% of initial risk for profitable exits on both positions.

- D: The long entry triggered nine bars after the setup bar, reached 100% of initial risk for a first position profit and then stopped out of the second position at breakeven. Notice in this example that although the initial stop was placed below the setup bar we later moved it below the swing low since the entry had not yet triggered. This was simply a common sense move to respect the recent price behavior.

- E: The short setup never triggered. When the CCI again crossed above the 200 level we cancelled the short order in anticipation of a new short setup.

- F: This replaced setup E. The short entry triggered one bar after setup and went on to hit both the 100% and 200% of initial risk levels for profitable exits on both positions.

- G: It took eight bars from setup to trigger this long. The stop was soon threatened and price came within a pip of stopping us out during this consolidation. We were lucky here. Price went on to hit the 100% of initial risk for a first position profit and we moved the stop for the second position to breakeven. We were faced then with a possible stop and reverse short setup (H) but it did not trigger so we were able to remain in the long trade until we hit the 200% of initial risk level where we exited the second position.

- H: At the time we got this short setup we were already in a long trade (G). This was a stop and reverse setup and we would have exited the long trade and entered a new short if the entry price was hit, but the entry was never touched and we cancelled the setup when CCI once more crossed above 200.

- I: The final short setup has been in progress while writing this article. For this one we added green lines to indicate the 100% and 200% of initial risk profit levels. Notice how price is approaching that first target. Once we get there we’ll book a profit on the first position and will move the stop for the second position to breakeven.

As is the case with all trading strategies we will also see losses with the CCI strategy, but overall it does a very good job of giving us an early entry into price reversals. Test it out on your favorite markets and time frames and tune it for each of those. On this chart a three pip entry offset and a five pip stop offset work well, but on a four hour or daily chart you’ll probably want larger offsets. Similarly you can adjust the 200 and 100 levels. If you’re seeing too many failed setups then consider using a 250 level instead of 200 to confirm an oversold/overbought level, and if you’re entering trades too late then consider a 125 level instead of 100 for your setup bar. Load the CCI on your chart and see what works best on that particular chart.

Below is a summary of the trading reversals strategy rules.

Long trades

- Wait for CCI to cross below -200. When CCI then crosses above -100 we have a long setup bar.

- Place an order for two positions. The entry price will be three pips above the high of the setup bar and the stop five pips below the low.

- Calculate the risk as number of pips from entry price to stop price.

- Place a limit order for one position at entry price plus risk. Place a limit order for the second position at entry price plus two times risk.

- If the entry has not triggered and the CCI crosses below -200 cancel the order.

- If the limit order for the first position is hit then move the stop for the remaining position to breakeven.

Short trades

- Wait for the CCI to cross above 200. When CCI then crosses below 100 we have a setup bar.

- Place an order for two positions. The entry price will be three pips below the low of the setup bar and the stop five pips above the high.

- Calculate the risk as number of pips from stop price to entry price.

- Place a limit order for one position at entry price minus risk. Place a limit order for the second position at entry price minus two times risk.

- If the entry has not triggered and the CCI crosses above 200 cancel the order.

- If the limit order for the first position is hit then move the stop for the remaining position to breakeven.

It’s also possible to trade this strategy with a single position. In that case simply place your target at the 100% of risk level so you’ll see a 1:1 reward to risk ratio on each trade.

Good luck in your trading with the CCI trading reversals strategy.

Posted in

Posted in