You’ve heard that “trading with the market trend” is a great way to take advantage of a bull market and a bear market.

Having some type of trend analysis is important for traders if you want to be on the right side of the bigger trading moves.

The fact is that trading counter trend should have you expecting smaller price targets as the dominant market trend takes over the market direction.

But trends end and if you are not monitoring for that when taking a position, you are putting yourself at risk of having a strong move against your position wiping out the gains you’ve made.

Technical Indicators For Trading

There are a few ways to determine trend direction of a market. Everything from price action to technical indicators can be used to determine if you are positioning in a bull or bear market. You must keep in mind that different time frames can have different trends.

A pullback on a daily chart can still be an uptrend. On the one hour chart which gives an x-ray into the daily chart, price will be making lower highs and lows as price declines. It is vital that you know which time frame you are trading when determining the trend.

You can use a moving average to determine the trend but there is a problem with that: moving averages are derived from price therefore the moving average will lag. Even worse, if you are using a longer term moving average such as a 50 EMA, you may be taking a position in that trend while price is showing the trend changing.

The closer you can stay to price when trading and looking for a trending market, the better off you will be.

What About Price Action For Trend ?

This is more in line with how I trade. I can use the price patterns of:

- Higher highs and lows for uptrend

- Lower highs and lows for downtrend

- Range breakout with momentum for trend direction

Keep in mind that nothing is guaranteed in trading and I can still get on the wrong side of the next price movement regardless of the trading technique I will use.

What is important is that traders use something that has a verifiable edge and you trade that with consistency.

For many traders, the simple trend line can be a lifesaver when it comes to being on the right side of the market trend. It is vital that you have a consistent way of drawing your trend lines. Without consistency, you will not know what to fix or tweak to improve your trading results.

The 3 step process to see a trend change in any market:

- Trendline is broken

- Retest and failure

- Price falls below the prior low

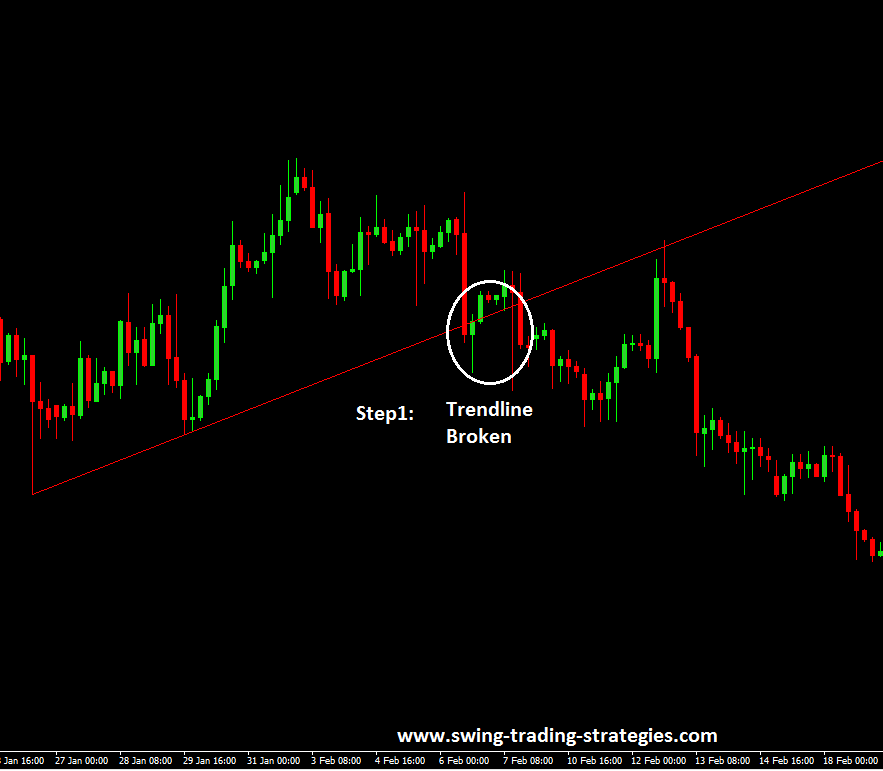

Step 1: Trend line Gets Broken

When a trend line gets broken it indicates that the current trend is most likely over. Currency pairs will often break trend lines. Sometimes, that means the trend is over. Sometimes, it will break it and and continue in the prevailing trend.

So how the heck do you know if a trend line break is really the end of a trend?

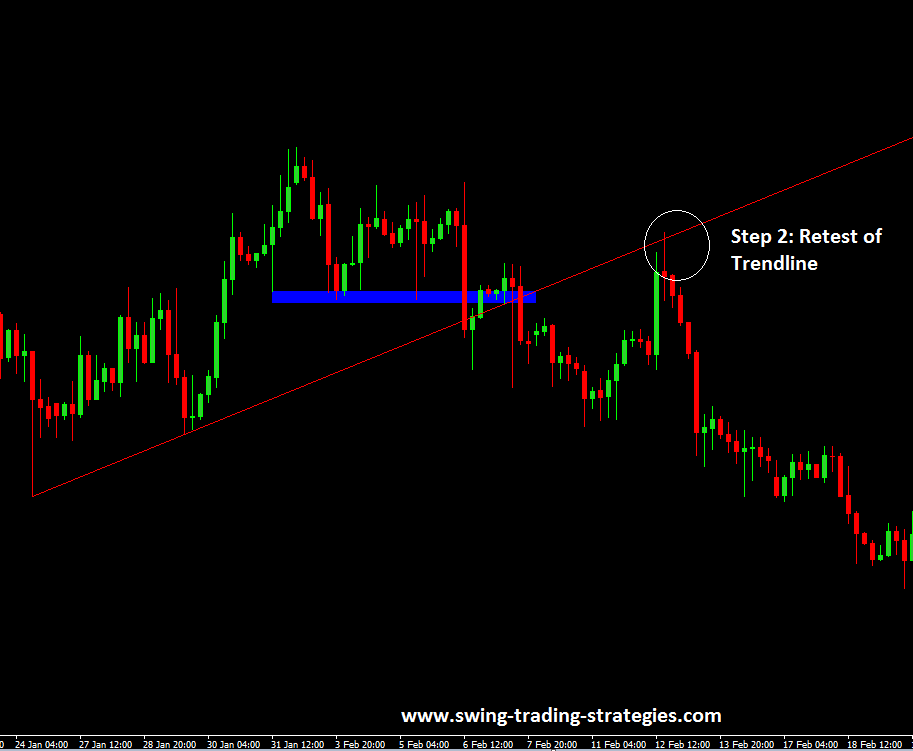

Step 2: There Is A Retest And A Failure.

When a currency pair is in an uptrend, it makes higher highs and higher lows. So when this currency pair fails to doe this, you should now go ” aha!” and begin to take a step back and ask yourself: is this trend going to end?

Here’s the thing: the currency pair has now tested that prior high but it has failed to continue to make higher highs. Now, the third step below is the final one. But look at what a Retest and a failure forex chart looks like:

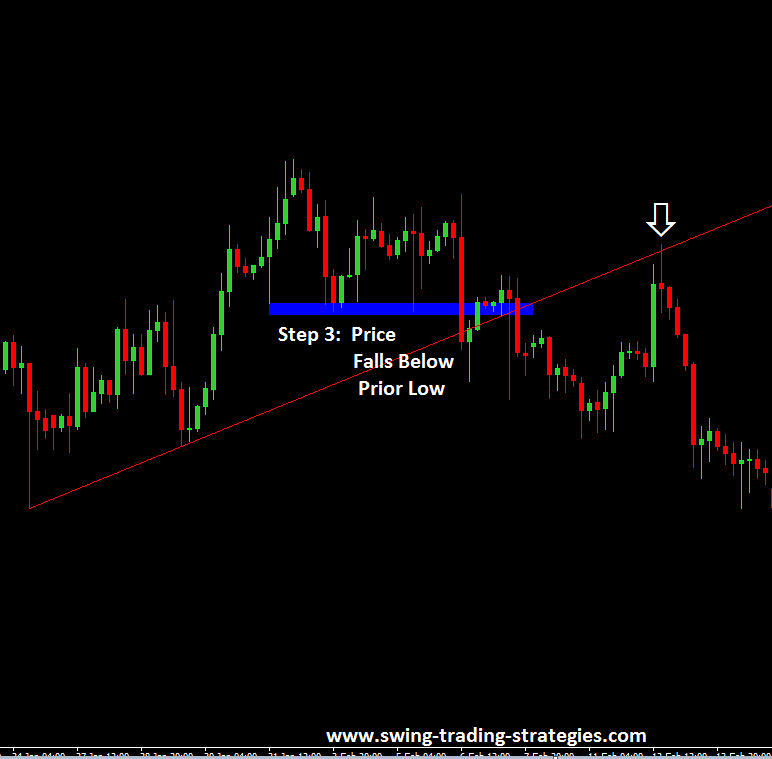

Step 3: Price Falls Below The Prior Low

So now, a currency pair that is in an uptrend is no longer making higher highs (in step 2). So what do you watch for next? Wait to see if price falls below the prior low.

When the currency pair has fallen below the prior low, then you have confirmation that the trend has changed.

Why?

Because now the currency pair is making lower highs and lower lows which is the definition of a down trending market.

Ok, so here’s what it looks like when price falls below the prior low:

How Can This Help You As A Forex Swing Trader?

As mentioned earlier, nothing is 100% in the market so there are some things to keep in mind:

- A trend line is simply a line. It does not act like a barrier to actual price.

- If the trend line breaks and price is showing weakness (changing from an uptrend to downtrend) watch the the retest of the trend line

- Failure of the trend line to regain prices is a sign of weakness

- You could be catching the beginning of a new trend

- Consider that you are trading a counter trend trade until the new trend is confirmed through price action and momentum in the new direction.

What is the vital key is that you learn to be consistent with all aspects of your trading. From drawing trend lines to risk management, nothing should be left to chance.

Posted in

Posted in