Learning how to trade pin bars can help a trader grab trade entries just as the balance of power is shifting between the bulls and bears.

Trading pin bars is one of those Forex trading strategies that can be learned quite easily and is great for swing trading because you may have caught a turning point in the market.

You can bring up any Forex chart and see how a pin bar reversal can often highlight important turning points although a higher time frame carries more weight than a small time frame when using any type of candlestick pattern

The pin bar, is one of the most high probability reversal candlestick patterns and if you can identify a pin bar on your Forex chart and know where and in what location on the chart it is occurring, you can make a great swing trade.

The pin Bar Trading Strategy relies on the Pin Bar Formation.

The Pin Bar Formation

The Pin Bar is a price action reversal pattern and when it forms, it shows that the price was rejected by the market at a certain price level or point. They stand out on the chart which makes them obvious and can bring order flow into the market if other traders take a position.

The Pin Bar

The Pin Bar is very different from other reversal candlestick chart formations because it is a bar/candlestick with a long tail or wick, a very short body. The name itself (the pin “bar”) refers to using a bar chart but I prefer using candlestick charts can help you see the formation clearly on a chart.

This is a more detailed analysis of the pin bar and then we will cover the Pin Bar Trading Strategy Rules.

For A Bearish Pin Bar Formation:

- The long tail tells you that the bulls took over and pushed the price up to form a high, but that high was not maintained.

- The bears came, took over and pushed price down all the way, wiping away the price gains made by the bulls

- The price fell, made a low and then closed below the opening price in the red.

When you see such a bearish pin bar formation, you should be alert that the bears are now most likely taking over the market and may continue to push price down.

For A Bullish Pin Bar Formation:

- a bullish pin bar formation is the exact opposite of the bearish pin bar formation: the long tail tells you that initially, the bears took control of the market and pushed the price all the way down to make a low but this low was not sustained.

- After the low was made, the bulls took over with such ferocity and force and pushed the price all the way up, completely wiping all the downward price moves made by the bears and making a high and finally closing a little bit below the high in the green

This means that when you see such a candlestick formation, you should be alert now that that bulls are most likely taking over the market and will continue to push price up.

BEST LOCATIONS TO TRADE THE PIN BAR

This is one very important criteria if you are looking to trade the pin bar: you just cannot trade all the pin bars you see.

It does not make any sense at all to trade all the Pin Bars you see because of one very simple reason: the location of where the pin bar forms impacts you probability of success.

So the best places to trade pin bars are in areas that technical analysis traders are aware of already:

- Fibonacci levels of 31.8, 50 & 61.8

- Major support levels

- Major resistance levels

- traders action zone

- pivot levels

- trendline bounces.

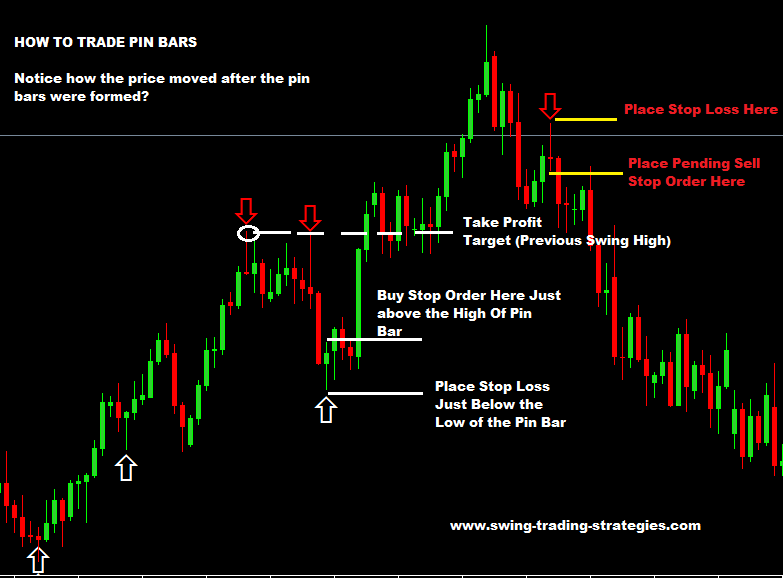

HOW TO TRADE THE PIN BAR FORMATION

Trading pin bar is really straight forward which makes it a go to trading method for price action traders whether they swing trade or prefer day trading.

Pin Bar Trading Strategy

- Wait and watch for pin bar to form on the levels above like Fibonacci levels etc..that I’ve listed above.

- Depending on whether its a bullish or bearish pin bar you will have to place a pending sell stop order 3-5 pips below the low of the bearish pin bar and place a buy stop order 3-5 pips above the high of the bullish pin bar.

- Place your stop losses on the other side of the pin bars of the same distances as you placed the pending orders, that is, 3-5 pips above the high if its a sell stop order and 3-5 pips below the low if its a buy stop order.

- Take profit targets: use previous swing high points/peaks or swing low valleys/bottoms as you take profit targets.

- When the price moves favorably, you have to lock in your profits by using the trailing stop technique where you move and place behind subsequent decreasing swing high points/peaks for a sell order and behind increasing swing low points/valleys/bottoms for buy order.

In this way, whatever happens, you have locked profits for that trade and if the market moves against you, you would have still made a profit anyway. Trailing your protective stop order allows you to stay in the market as long as possible before the reversal takes you out.

BEST TIME FRAMES TO TRADE THE PIN BAR

I believe the larger time frames are the best time frames to trade the pin bar: you should be looking at pin bars in the 1hr, 4hr and daily time frames.

If you are trading in the 1hr, don’t be just focused only on 1hr charts, check in the 4hr charts as well because sometimes you will notice that you may not see a pin bar in the 1hr chart but in the 4hr chart, a pin bar may be forming which you will not see because you are so focuses on looking at one hr charts only.

What I’m saying is learn to use multi-timeframe chart analysis. This is an essential trading skill all forex traders should know.

I have a pin bar indicator for Metatrader that you can download here

Posted in

Posted in