Bollinger Bands were developed by John Bollinger in the 80’s and is without doubt one of the most popular indicators for swing trading in forex. Bollinger Bands measure price deviation from a central point – the moving average.

The theory behind the Bollinger Band indicator is that when price deviates from the mean (the moving average), price can be considered either oversold or overbought. When measuring oversold or overbought, traders will generally look for a trading opportunity.

Oversold: Look for reversal trades or this can be the first part of a setup for another short trade at the moving average. Oversold is a bearish condition.

Overbought: Look for reversal trades short or this can be the first part of a setup for another long trade. Overbought is a bullish condition.

There is something special about Bollinger Bands that adds a little twist to deviations: the indicator adds in a volatility measure.

Why is a measure of volatility important?

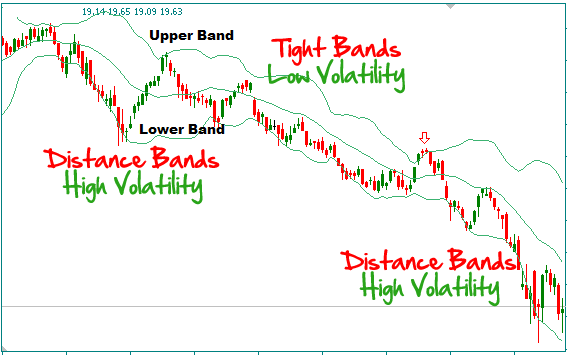

The upper and lower bands of the Bollinger Bands will contract and expand depending on price movement.

The larger moves in price will expand the bands which will require a larger moves of price to reach the upper or lower band (deviate from the average price) to better reflect the volatility of the market you are trading.

Remember, we need volatility in price to make money. If markets, whether Forex, Stocks or whatever, or not moving, you don’t make money.

When markets over overextended from the average price (deviating from the center line of the bands) we can expect the market to mean revert. Mean reversion is a time tested mechanic of price movement that happens in every market.

Mean reversion simply means a pullback or rally of price to the average (mean) price over a set time period.

BOLLINGER BAND CALCULATION

Here’s how the bollinger band is calculated:

- The Middle Bollinger Band is simple a 20-period Simple Moving Average = Average of Last 20 Closing Prices

- The Upper Bollinger Band is calculated by adding 2 standard deviations to the Middle band = Middle Band + 2 x SD

- The Lower Bollinger Band is calculated by subtracting 2 standard deviations from the Middle band = Middle Band – 2 x SD

Standard deviation

- standard deviation is a statistical indicator that measures the average deviation of each number in a sample from the average number.

- the higher the number, the more scattered the sample which means the higher the volatility of the currency pair.

So from knowing how the bollinger band is calculated, you can say that the more distant the upper and lower bollinger bands are from each other, the higher the volatility of the market.

The chart below shows and example of this:

TRADING BOLLINGER BANDS

These are the 4 best ways on how to to trade with Bollinger bands.

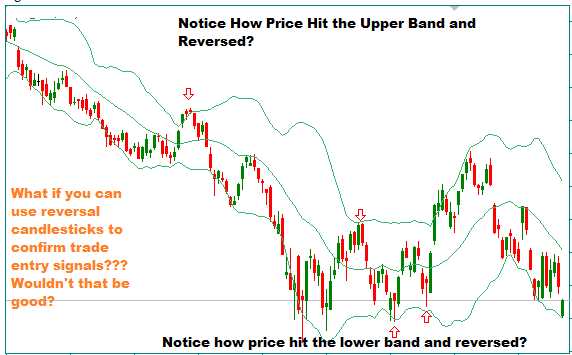

Method One: Trading The Dynamic Support And Resistance Of Bollinger Band Lines

You will notice that the upper and lower bands can be used as resistance and support levels respectively. So when you see a price hit the upper and lower bands and a reversal happens, it can lead to some big moves and you can use that as your trade signals.

Note: with the kind of trading system above, its best to trade in a trending market as the signals will be more reliable. Ranging and non tending markets will give you problems with this.

For example, if the market is trending down, you must only look for sell trade when the price hits the upper bollinger band line and possibly confirm your entry with a bearish reversal candlestick pattern.

The opposite is also true…if the market is trending up, then only look for buy signals when price hits the lower Bollinger band line.

I want to point out the the outer bands don’t actually support or resist price movement. It is a general zone where price has extended far from the mean (average price) and we can expect an adverse move in price.

Method Two: Trading the Fixed Horizontal Resistance And Support Lines In Conjunction With Bollinger Band Lines

This method is fairly simple. What you are looking for is a horizontal support or resistance level which coincides with price touching the upper or lower bollinger band in this level.

It is also important to make sure that there has been price reversal at least once on this support or resistance level which will allow it to have significance thus making trading signals more reliable. See chart below for example:

Method Three: Trading Breakouts Of Bollinger Bands

Watch for price to break through the upper or lower bollinger band lines. Make sure the candlestick closes above the upper bollinger band line before you buy or close below the lower bollinger band line before you sell.

In a very strong trending market, this method works well but let’s be honest, in strong trends, a lot of things work well.

But having said that, the signals produced from trading bollinger band breakouts like this are less reliable.

Why?

Because usually by the time you enter a sell or a buy trade, the market will reverse and you will get stopped out.

However, there’s a last trading method below that allows you to take breakouts of bollinger band lines and the trades from this can give you very good profits…its called the bollinger band squeeze.

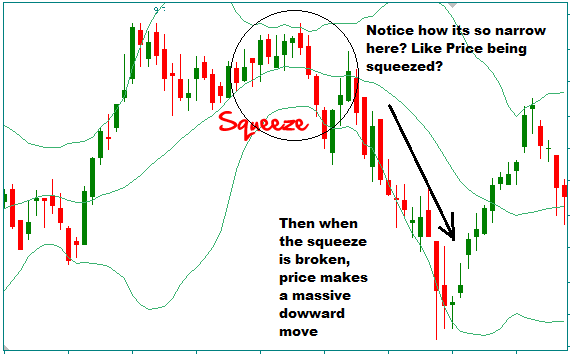

Method 4: Trading The Bollinger Band Squeeze

When you see price trapped or “squeezed” between the upper and lower bollinger band lines, it means that the market is a period of low volatility and its a matter of time before a breakout happens…either up or downward. This is a prime chart location to look for breakout trades from consolidations in price.

The bollinger band indicator allows you to see this squeeze and capitalize on the breakout that happens afterwards. The thing is, we know it will break out – we just don’t know when.

You can place pending 2 pending stop orders on both sides just outside the squeeze which will trigger when a breakout happens. Once one pending order is activated, cancel the other pending order.

Or you can place stop loss on the other size of the squeeze or halfway point between the squeeze.

Another way to trade the bollinger band squeeze is allow the breakout to happen and then wait for price to reverse to touch the middle bollinger band line and enter an order when price starts to head back in the breakout direction again.

In the chart above, notice that a breakout did happen when a red candlestick closed below the bollinger band squeeze but the next candled was bullish and price went up to touch the middle bollinger band line then once it touched it, price reversed all the way down…a big downward move.

The best thing about trading chart breakouts is that trends start with breakouts. This is why swing trading is a popular form of Forex trading and other markets. You catch the beginning of a trend and you can make your year with one trade.

Bollinger Bands Need A Complete Trading Strategy

It is far too easy for traders just to slap this indicator on their chart and start trading. You must test how you will trade Bollinger Bands as part of an overall trading strategy:

- When will you exit?

- Where is your stop loss?

- What does your trade setup look like?

- How much will you risk per trade?

- What markets will you trade?

If you are Forex trading, remember that not every currency pair has enough volatility. You may see far too many Bollinger Band squeeze setups but no trigger. Stick to the major currency pairs and include the EURJPY, GBPJPY, and even the GBPCHF.

Posted in

Posted in