Hello traders,

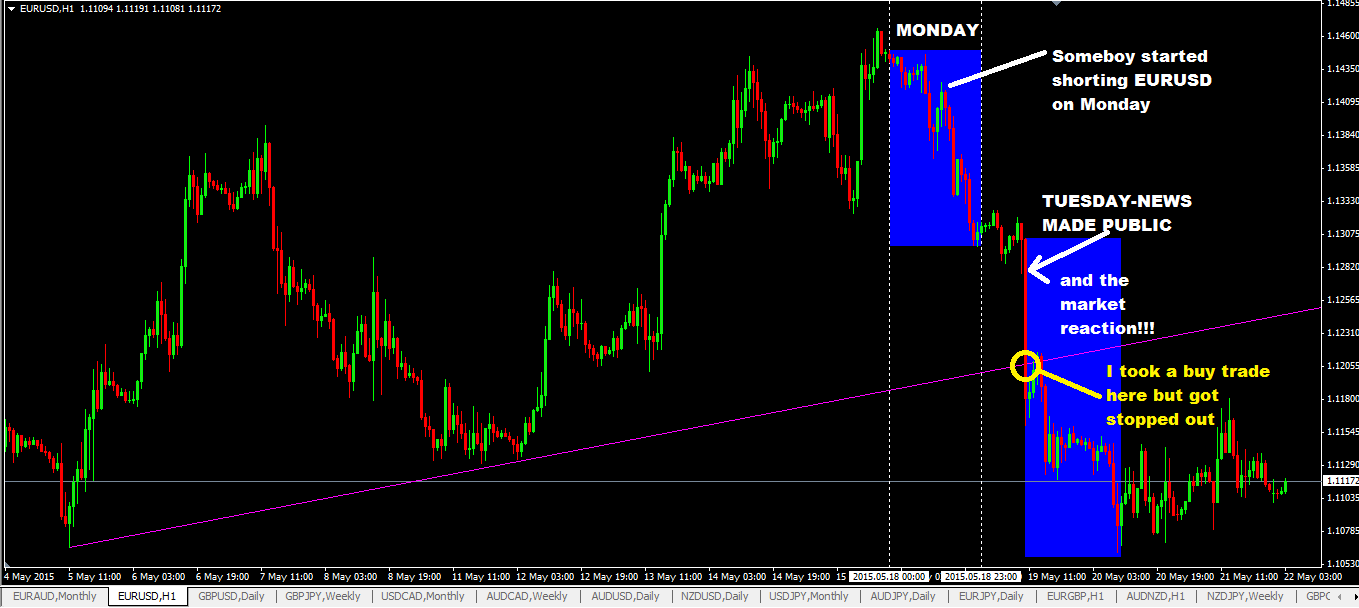

if you have been watching the EURUSD charts on Monday 18th May 2015, you would be right in thinking the EURUSD was in an uptrend (based on the 1hr chart).

So I was waiting price to come down so that I can buy on the bounce of an upward trendline and that setup happened on a Tuesday. See chart below. But then there was a massive price spike downward and even though, I bought at the touch of the trendline, because this downward momentum was so strong, I got stopped out with a loss. Price did not respect that upward trend line.

I was caught by surprise by this sudden downward movement on Tuesday and wondered what caused the price to move like that, because there was no major forex news in EURSUD scheduled to be released that day that would move the forex market like that.

In fact, in my mind, I thought this trade setup fitted all the trading conditions to give a really good risk:reward ratio trade.

But then something happened to change all that. There an information leak regarding the change in the European Central Bank’s bond-buying policy.

You see, I took the trade on a Tuesday, but the information leak happened on Monday so some traders with big pockets were already shorting the EURUSD on Monday with inside information only available to a select few!!!

HERE’s WHAT HAPPENED:

- there was a selective closed-door meeting of a bunch of traders, economists and central bankers on Monday Evening (European Time presumably).

- ECB board member, Benoit Coeure said at that private meeting that the bank wold probably accelerate its May and June bond-buying which is supposed to stop out at 60 billion Euros a month.

- the text of his speech wasn’t made available to the world until Tuesday Morning.

So if you look at the chart, you can see that EURUSD started falling on Monday. People who had access to this inside information were definitely shorting the EURUSD before the world even had a chance to know what was going on.

IS THIS INSIDER TRADING INFORMATION?

What’s insider trading information? Insider trading information is defined as these:

(i) is of a precise nature;

(ii) is not generally available;

(iii) relates, directly or indirectly, to one or more issuers of qualifying investments or to one or more qualifying investments; and

(iv) would, if generally available, be likely to have a significant effect on the price of those qualifying investments or the price of related investments;

(d) information is precise if it:

(i) indicates circumstances that exist or may reasonably be expected to come into existence or an event that has occurred or may reasonably be expected to occur; and

(ii) is specific enough to enable a conclusion to be drawn as to the possible effect of those circumstances or that event on the price of qualifying investments or related investments;

So from this, you can see that Coeure’s remarks qualify as exactly the kind of inside information that regulators don’t want traders benefiting from.

Which really means, who ever profited from this insider information needs to be investigated and put in jail.

SO WHAT DID ECB SAY IN RESPONSE TO THIS?

Could you believe it? They said it was a Procedural Error and that Coeure’s remarks should have been made available on Monday Night in accordance with ECB’S standard practice of distributing speeches to the media in advance, together with strict instructions not to publish anything before the blathering is scheduled to start.

This is simply a load of bullshit in my opinion. There should never be any meetings like this in the first place for passing on information to only a select few. That is criminal.

SOMEBODY MADE A KILLING IN THE FX OPTIONS MARKET

Mike Gilbert, a Bloomberg View columnist wrote an article about this ECB Information leak and this is what he had to say:

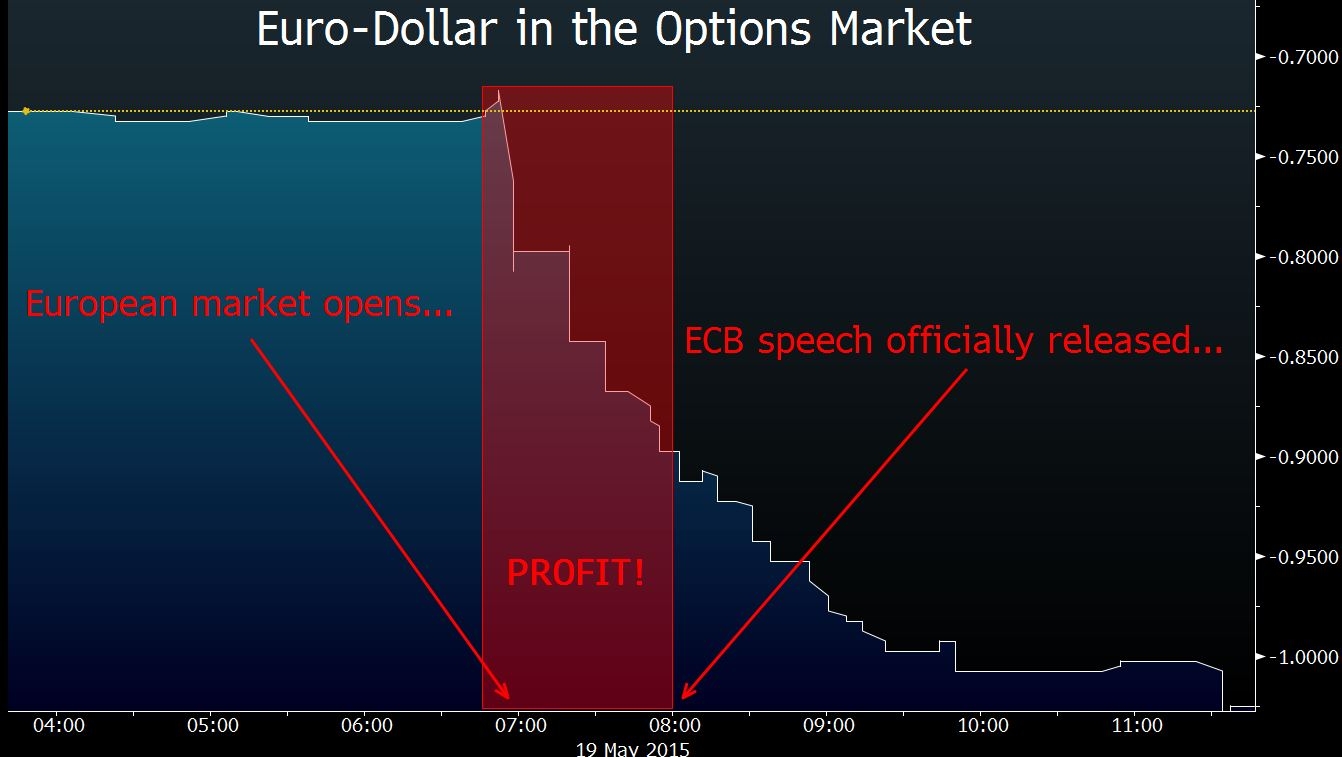

On Tuesday, I compared the moves in the euro before and after Coeure’s comments were made available to the general financial community. But a trader in Singapore who wishes to remain unidentified reckons I looked in the wrong place. The real action (and profit opportunity), he says, was in the options market. Judging by the price action on this chart, he’s right:

The chart shows something called risk-reversal: As more traders bet on a euro decline using options, the line on the chart starts to head lower (you can read a fuller definition here). To make money, you’d use options rather than speculating directly against the euro because options have what’s known as leverage: You get more bang for your buck. My Singapore trader says he watched the options market start moving a bit more than an hour before Coeure’s speech was released to the media. That’s about when Europe opens for business; prior to that, there wouldn’t have been sufficient liquidity to put on a big trade.

I’d argue it’s very hard — impossible, even — to look at that chart and not conclude that someone made money using the information Coeure divulged the night before.

FOREX MARKET NOT A FAIR PLAYING FIELD?

This story has a similar pattern to what I published here on these two articles:

(1)How I Profited 570 Pips In GBPCHF When Swiss National Bank Discontinued Minimum Exchange Rate

(2)Someone Knew Exactly When The Swiss National Bank Would Discontinue Minimum Exchange Rate

What’s your take on this? Do you think the forex market is not a fair playing field if only select few people have access to such information and use it to their advantage and profit big time whilst you and me are getting knocked around in our trades because of all that information that we did not have access to in the first place to proper decision in our trading?

In a market where you think its not a fair playing field…what do you do to protect yourself?

Actually, you can protect yourself and you can win. An its all comes down to very 3 simple things in my opinion:

- use your edge-this you your discipline, waiting for the right trading setups, having a reliable forex trading strategy etc. These are your strengths. You may get knocked around a few times because of unexpected situations like I’ve described but keep cool and keep your edge.

- manage risk-I really don’t need to talk alot about this, you know what I mean…boom or bust of your forex trading account depends on this single thing alone.

- expect the unexpected-let it never surprise you and me these days that anything can happen and impact the forex market and this can drive prices up and down like crazy. Sometimes, if you are already in a trade, it will work for you but sometimes it wont, you can lose a lot of money. Solution? Manage your risk. Know how much you are risking each trade before you press the buy and sell button.

Don’t forget to share and tweet by clicking those buttons below. Thanks

Posted in

Posted in