There are many things that Forex traders should know and one of the most important ones is: To profit from swing trading Forex is not easy.

The Forex market can take an overconfident trader and humble them faster than any other venture out there.

Why is that a trading truth?

Because trading is a meritocracy. It does not care:

- How smart you think you are

- What type of education you have

- How much money you have

- Who you know

- Whether you are male or a female.

I’ve seen, and I’m sure you have, books and courses where the say silly things like “Easy Forex” or “Make Money Easily Trading FX”. If you ever see that, run.

To some extent, learning Forex Swing Trading Strategies and Systems is the easy part. Anybody can learn a trading strategy whether it’s one of the basic FX strategies on this site or any boxed method, it is easy to learn.

However no-one really has a heaven sent formula or process or rules for controlling greed and emotions that happen when its your real money on the line.

The fact is that the biggest enemy to trading is you. Your emotions.

The Holy Grail To Trading Is No Secret

The holy grail of Forex swing trading is when you truly learn to start controlling your emotions, having patience to wait for the right trading setups and having strict money management. That’s a

long way of saying to ensure you have a trading plan.

Added onto that, you need:

- a lot more work

- more practice

- dedication,

- understanding of the psychology of the currency markets.

It also means you may not succeed in the first attempt at Forex trading or your success may be short lived.

But you have to be able to get up and fund your blown Forex trading account for the 2nd time around or the 3rd time or the 4th time or the 5th time. You can take steps to prevent blowing out your account by adhering to good risk protocols and sticking to your trading plan.

Very few people can succeed at the very first attempt at trading. The majority have to go through the school of hard knocks. Which means, you may lose money in your first attempt, second attempt and third attempts.

It may seem like doom and gloom but there are many swing trading success stories that you can read up on to hopefully inspire you to tackle trading like a professional.

FOREX SWING TRADING IS NOT GAMBLING

Many Forex swing traders enter Forex trading and take it like gambling.

Here is the difference between gambling and Forex trading: gamblers don’t have a game plan or strategy when gambling. They just pay the casino to play.

In this regard, they have more in common like the unsophisticated Forex swing traders who lack discipline and for this reason, they tend to lose more often.

Even if they have a plan, it may have not be thoroughly back tested and demo traded before implemented live in a live trading account.

HOW TO PROFIT FROM SWING TRADING

To profit from swing trading, there are a few things you need to do.

Successful Forex traders have plans and they follow it strictly. This is the main difference that sets successful Forex traders apart from the rest.

- A trading plan is meant to be followed.

- A trading system rules is meant to be followed.

I know it is a real challenge when you are constantly following the rules but fail to make money. This happens to every Forex trading strategy, be it scalping system, swing trading system, trend trading or position trading.

If you think in the long term and think in terms of trading probabilities, it makes sense to keep following the trading rules rules regardless of what is happening in the “now.”

If a swing trading system has proven to be successful, keep following its even if you have lost 8 trades in a row yesterday. Eventually you will get profitable if you stick to the trading rules and assuming your trading method has a positive expectancy.

It is sign of maturity and serious trading approach when you have a very strong trading discipline even when you have been taking losses but have kept going on without changing your trading plans or trading out of emotion.

MONEY MANAGEMENT (OR RISK MANAGEMENT)

You can strictly follow a trading plan or rules of a swing trading strategy but without a good money management, you will never profit from swing trading because you will blow out your account. Before you take a trade, you should also calculate and know how much you are risking on each trade.

Don’t over leverage yourself and trade more contracts or lots than your Forex trading account can handle no matter how promising a trade may look in terms of potential profits to be made.

There is a rule of thumb that says never trade more than 2% of the funds available for margin. For some, even that is too aggressive but it’s a good starting point.

Speaking of risk management, understand that if you begin swing trading with low capital, you are already putting yourself in the hole. Ensure you have enough funds that you can use for your trading education because that is exactly what it will be when you hit the live markets.

FOREX TRADING LOSES ARE REAL – EXPECT THEM!

Many go into Forex trading not expecting the reality of loses and when they strike, sometimes even to the point of completely wiping their Forex trading account, they are completely at a loss how it all happened that way.

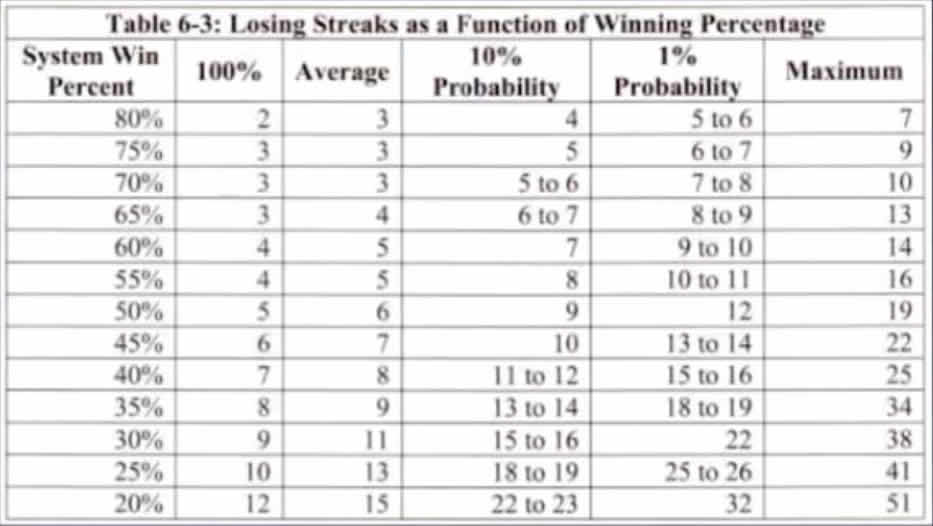

This graphic shows the possibility of losing streaks in relation to your trading systems win percentage.

Profit From Swing Trading

You see, in every trade you place, there is no guarantee that you will come out profitable. Your attention should be more focused on minimizing your loses. Less focus should be on how much profit you will make. One good way to think of yourself is that of a risk manager. Make your job be all about managing risk and that will be a constant reminder that win and losses will come in a random distribution.

You want to be around for the winning streak.

Part of being a successful trader is the ability to handle loses in a detached manner, knowing that it is expected and as long as that loss has already been considered before a trade was taking place and falls within the specified trading risk allowed for that trade.

You can see that even with a 70% winning system, it is quite possible to have up to 10 losing trades in a row. If this does not make you understand the importance of risk management and protecting your FX trading account, nothing will. You can see you are guaranteed at least 3 losing trades in a row.

FOREX LEVERAGE MULTIPLIES PROFITS FAST…but…

But Forex leverage has also another side: it can multiply your loses fast too. Forex Trading with Leverage can do miracles for those that really know how to use it.

What is the secret? Answer: Risk Management. Strictly control your risk and leverage will work exceedingly well for you.

I know I keep talking about risk management because it is that vital to your trading success.

TRADING PSYCHOLOGY

You truly know who you are when your money is on the line. Forex Trading is a serious emotional roller coaster for those that don’t have a trading plan with effective risk management in place.

When you are in profit and you win you are happy.

When you start to win more, you think trading is easy and start to trade larger sized lots, sometimes over leveraging your account

When you suffer losses (and you will), they are amplified and all your gains you have made have been given back to the market.

If you start out losing, there is tendency to fight the market to get back what you lost. Many Forex traders go along this path and eventually end up losing most or all of their trading accounts.

This is not the way to do it. Instead accept that the market may not be in favor at that time and you should be honest enough to analyze your own trading mistakes and improve from it.

The Life Of A Swing Trader

One of the biggest draws for swing trading is the lack of screen time that is required to trade. Unlike day trading, swing traders do not have to live at their computer desk in order to trade. Often times, swing traders use end of day data to analyze the market.

I started with day trading and once my capital increased, I moved more to the swing trading side. I spend part of the weekend with a quick scan of the FX charts to see where prices ended up.

I will find which currency pairs fit my trading requirements and will often set alerts at price points depending on the trading setup.

For entry, I will use stop orders to ensure that at least in the short term, momentum in the market is heading in my direction.

Immediately upon trade entry, a protective stop loss is set to limit the losses that can certainly come.

Then, trades are managed on a daily basis. I, like you, didn’t get into trading to be chained to a desk. It was the freedom that trading can give you. Sadly, many traders end up stuck at their desk much longer than they would working a full time job…and usually making less money.

Keep Learning About Trading

If you want to profit from swing trading, you must keep learning, be it from your own trading mistakes or the mistakes of others. Learn from your successes as well.

Learn from others who are more successful Forex traders than you.

In this way, you know what works and what will not work and this may also re-enforce some of the discoveries you yourself may have made as you started in the path of Forex trading.

Posted in

Posted in