This CCI Swing Trading Strategy is based on the Commodity Channel Indicator.

A bit of history and lesson about the CCI:

- Commodity Channel Index (CCI) is an oscillator introduced by Donald Lambert in 1980.

- Though its name refers to commodities, it can also be useful in equities and currency trading as well.

- CCI measures the statistical variation from the average.

- It is an unbounded oscillator that generally fluctuates between +100 and -100.

- ForexTraders use the CCI in a variety of ways. Three common uses are:

-CCI in retracements

-CCI on breakouts

-CCI in divergent trades

But today we are going to just focus on trading the CCI divergence.

HOW TO TRADE CCI IN DIVERGENCE

Before you trade the CCI, first identify the direction of the prevailing trend. If you are trading off of a 4 hour chart, determine the direction of the daily trend. If you are trading off a 15 minute chart, determine the direction of a trend on the 1 hr chart etc.

Why? You may ask?

Than Answer is simple: because you want to be taking trades based in the direction of the main trend when you are trading in smaller timeframes. And you will have much more clarity on what the main trend is when you check in larger timeframes.

Here are some few important points you need to be familiar with:

- When CCI is above +100 value, it is considered overbought while below the -100 value is considered oversold.

- As with other overbought/oversold indicators, this means that there is a large probability that the price will correct to more representative levels.

- Therefore, if values stretch outside of the above range, a retracement trader will wait for the cross back inside the range before initiating a position.

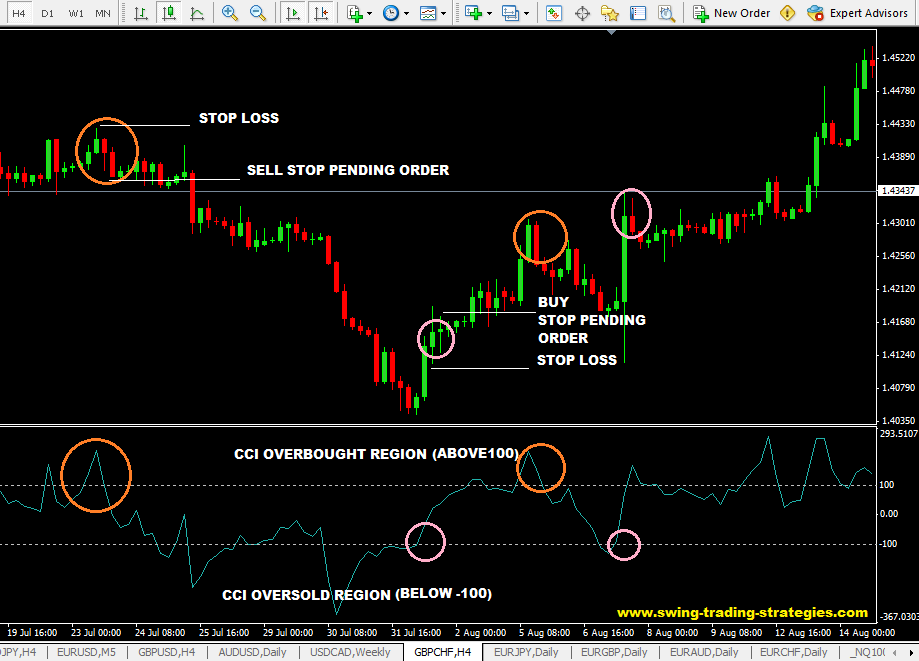

Buy Trade Setup For CCI Swing Trading Strategy:

- Wait and watch for CCI value to go below -100(oversold region) and once it comes back and crosses above the -100 line, you place a pending buy stop order 3-5 pips above the high of the candlestick after it has closed.

- Place you stop loss below the swing low or if the candlesticks is quite long, then place it anywhere from 5-10 pips below the low of that candlestick.

- Your take profit target should be place at least more than 2 times the distance of what you risked.

Sell Trade Setup For CCI Swing Trading Strategy:

Its just the exact opposite of the Buy Setup…

- Once CCI Value goes above 100 (overbought region) you watch and wait until the line comes down and crosses the +100 line do the downside and then you place a pending sell stop order 3-5pips below the low of the candlestick that was formed that caused the CCI value to fall below the +100 line.

- Place you stop loss at the swing high or if the candlestick is quite long, then place it 5-10 pips above the high of that candlestick where you placed the sell stop order at.

- Similarly, aim for profit targets 2 or more times what your risked or simply Risk:Reward Ration of 1:2 or more.

So there you have it, the CCI Swing Forex Trading Strategy . Try it out and see how it works for you.

Did you enjoy this? It would mean the world to me if you shared it:

Posted in

Posted in