The double top chart pattern is a reversal pattern that can be seen in all time frames. It often forms when price has moved up for an extended amount of time, forms resistance, pulls back and as traders try to get in on another leg, price stalls at the previous swing high.

Once traders see the previous swing high is not violated by current price, a few things begin to happen:

- Traders that are holding longer term longs such as a swing trader, began to take profits

- Traders that get into the last leg up, start to panic and exit their longs

- Counter trend traders see price not able to break the swing high (resistance) and look to short the market.

The selling action from shorts and from those exiting long positions (who must sell to exit), fuel price to the downside.

IDENTIFY THE DOUBLE TOP FOREX CHART PATTERN

It is not complicated issue to identify a double top chart pattern. Being a reversal pattern from a previous swing high, you can easily scan for swing highs and set an alert when price revisits that price zone.

- Two tops, top 1 & top 2 (or swing highs or peaks )that are almost on the same price level. Financial markets are not perfect so expect some price splash around the levels.

- There should be equal distance in terms of time it takes to form the highs (peaks)

- Some currency futures traders like to include a third requirement to classify a double top: volume. They want to see a decrease in volume on the second high. This give them added confidence that the buyers are losing steam and a price reversal can happen.

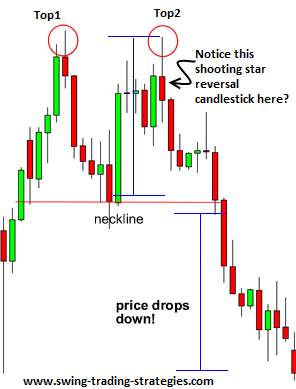

Let’s review this chart:

- Two tops or peaks were formed after a strong move upward.

- The second top or swing high (or peak) was unable to break the second top or swing high (top 2).

- When price does not break this resistance level above top 2, this is a strong indication that a reversal is going to occur.

As a Forex swing trader, once you see all these things lining up, you know you are should take your trade because price usually moves fast downward once top 2 resistance level is not broken to the upside.

Why?

Failed expectations.

When price fails to move as a trader expects, panic can often set in and they will exit their positions. Nothing scares a trader more than a loss (and that is not a good thing to be afraid of!).

Price doesn’t even have to test a traders protective stop loss. Once they see their P/L start to shift, they grab the profits that they have.

Even though the double top is a reversal pattern, it does not always mean a full scale trend reversal. It can also be setting up a short term correction in the market.

Trading The Double Top Chart Pattern

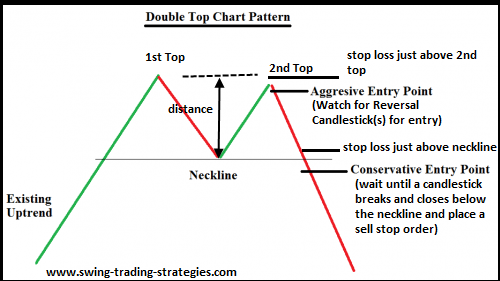

Trading the double top Forex trading strategy is simple and there are three ways to trade it:

- The Aggressive Entry

- The Reversal Candlestick Entry Technique &

- The Conservative Entry

Rules of The Aggressive Trade Entry

- Once the first top is formed and now you see price going back up to that level, place a sell limit pending order just 3-5 pips under the high of the candlestick the formed the Top 1.

- ou can also sell instantly at market order as soon as price is within 3-5 pips of the high of Top 1 candlestick.

- Place your stop loss at 10-30 pips above the high of top 1 candlestick or use the ATR stop loss strategy here

- For take profit targets, you can use the neckline as your take profit target level 1 and or even use the previous swing low below the neckline for your take profit target.

Rules of The Reversal Candlestick Trade Entry

- Once the second top is formed, what you do is watch for a bearish reversal candlestick formation.

- Place a sell stop order just 3-5 pips under the low of the bearish reversal candlestick formation.

- Place your stop loss at either a few pips above the bearish reversal candlestick formation, 5-10 pips or you can place it just a little bit outside of both the 1st top and the 2nd top, anywhere from 5-20 pips.

- For your take profit target, you can use the neckline as your take profit target level

Rules of the Conservative Trade Entry:

- Wait for price to break below that neckline. Make sure the candlestick that breaks the neckline must close below it.

- Then place a sell stop order 3-5 pips under that breakout candlestick’s low.

- Place your stop loss anywhere from 3-10 pips above just above the neckline or just above the high of the candlestick.

- For you take profit target, calculate the distance in pips between the neckline and the 1st top (or the second top…whichever you prefer) and use that number to project your take profit target price level.

The bigger problem I see with trading using the conservative approach is your stop loss would be too large if the neckline is too far away from the tops. This can often happen if the reversal begins with a large momentum candlestick to the downside.

Advantages of Trading Double Tops

- The downward moves that happen after the formation of the 2nd top can go a long way, even for weeks, if you are trading off the daily chart and if you continue to ride the trend, that’s means you make lots of money too.

- This is price action trading at its best

- Easy to spot and trade once you know what to look for

- The risk for each trade is much better compared to other forex trading strategies simply because you will be using support and resistance levels to place your stop loss.

- What this means is that there is less chance of you getting stopped out frequently.

Disadvantages

- Sometimes you will come across situations where there will be price spikes just to trigger all the stop losses placed just above top 1 and it would seem as there would be a breakout to the upside but this is just a trick.

- Price fall back all the way down. (The key is being vigilant and if a price spike takes you out with loss, then watch and wait to see if you enter on the 2nd time…just wait for another reversal candlestick…even if it is the spike candlestick, enter again!)

- Trading in smaller time frames anything below 1 hr may not be really good. The higher the time frames you use, the better. I personally use chart patterns such as this on daily charts and above.

Note: You can also use double tops on lower time frames as a means to enter a larger time frame rally.

Posted in

Posted in