This is a variation of the floor traders Forex Trading method and the only variation is not to use a stop loss initially when you enter a trade.

Disclaimer: I’ve not tried this myself, its just an idea that needs to be tested on a forex demo account. I do not recommend you follow this system on a live trading account.

So if you blow your forex trading account then don’t blame me.

HOW THE FLOOR TRADER’S METHOD WITH NO INITIAL STOP LOSS WORKS.

Now, this is the idea:

- When you enter a trade based on the floor traders forex trading strategy, the only thing that you do is not to place a stop loss initially.

- You will place a stop loss later when the market/price moves in the direction you anticipated.

Now, why would this trading idea make any sense?

Well, Let me explain….

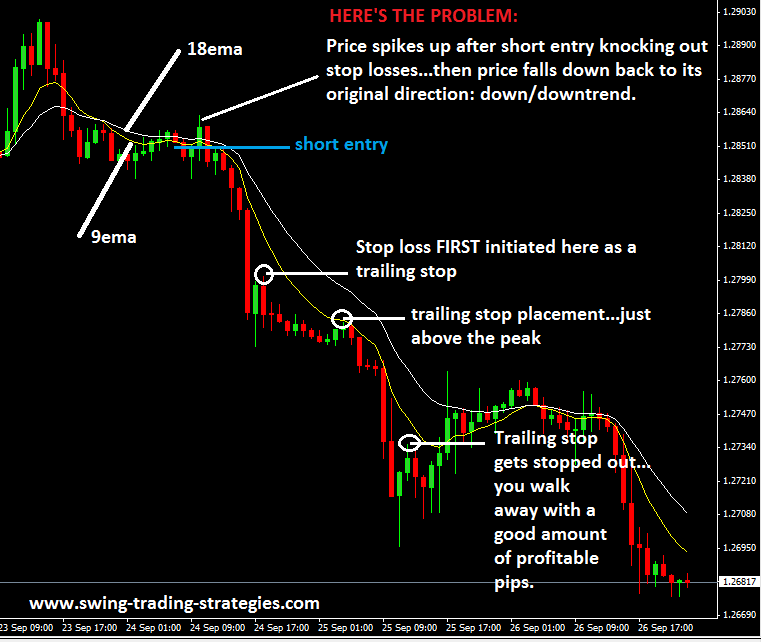

You see, the floor trader trading system works by using a 9 & 18 ema cross over and waiting for price to reverse and then selling or buying on the continuation of the initial trend.

But here’s the main problem with the floor trader’s forex strategy:

- you really cannot pinpoint the exact turning point when the market ends its minor reversals to continue in the opposite way it its original direction.

- so its bit of a guessing game when you are looking for point of trade entry by using reversal candlesticks or using the the violation of low/highs of previous candlesticks as as entry points.

So what does this mean if you’ve already taken a trade and the market hasn’t turned to continue in its original direction?

Well? It means depending on how far you’ve placed your stop loss, your stop loss may be about to get hit or you are already stopped out in your trade. Sound familiar?

And when your trade gets stopped out, then the market starts to continue in its original direction.

The following forex chart below should make you understand this concept better:

WHEN DO YOU NEED TO START USING STOP LOSS IN THIS TRADING SYSTEM?

These are some suggestions only so you should see which one best works for you and try it out:

- once your trade goes in the direction as anticipated and starts to form lower peaks (like shown in the chart above), you need to use swing points/peaks to move your trailing stop loss and start locking in profits until you get stopped out or your profit target level price gets hit.

- or after you’ve place a short trade and then a candlestick closes ABOVE the 18EMA line, you need to activate a stop loss by placing it anywhere from 3-15 pips above the high of that candlestick and this should depend on how much risk you are willing to take. If the next candlestick opens and does not go higher than the previous candlestick and the market starts to fall back down then apply the trailing stop technique as mentioned above-locking profits as market continues to move lower.

YOU NEED TO WATCH YOUR TRADE

When you are using the floor traders method with no stop loss, here are some important things to consider:

- you cannot leave your trade running and go to sleep…if this is a live account. Why? Because you don’t have a freaking stop loss yet. You need to wait until you place your stop loss and maybe have locked way some profits then you can relax.

- do not trade this system when a major forex news is about to be released soon.

- know how much risk/hit you are willing to take on your forex trading account before you enter a trade. Keep this figure in your mind while trading. If you see that the trade is not going as planned and the paper loss in your trading account starts to hit your risk level, then get out. Its better to lose a small amount of money in your trading account and wait another day for good opportunities to trade than to take a big hit/loss on your trading account which depletes significantly your trading account and takes a long time to bring back to original trading account balance (if you are that good…:) otherwise, you are busted!)

IN SUMMARY

- The floor traders method with no stop loss system is a system that allows you to avoid the initial price spikes just after your trade entries by not placing a stop loss initially. This is what this trading system is really about.

- However, you will need to activate stop loss once trade moves either favorably or you see candlesticks closing above 18ema line (for sell/short trade) or closing below 18ema line for a buy/long trade.

Posted in

Posted in  Tags:

Tags: