Out of all the Forex trading strategies, using some type of trendline break strategy in a trend trading type of market condition is a very popular one. A trendline is simply a line that connects higher lows in an uptrend and lower highs in a downtrend in the currency of your choice. I’m not here to say whether it’s a profitable strategy or not because that depends on many other variables outside of just drawing a line.

Trendline Example In An Up Trend

I’ve always been a believer that whatever you must do in order to frame the price in a way that you can understand and trade it, just do it. The only right or wrong thing when it comes to trading pertains to risk and that is: It is wrong to risk so much that one bad trade can take you out of business!

Is There A Correct Way To Draw A Trend Line?

Before we go further into my trading tip, let’s answer this question. There are a few schools of thoughts when it comes to drawing a trend line. Some will say don’t cut through price while others believe that a line has predictive value in the future. (whether or not I believe it does is not relevant)

Others will draw on the extremes while others will use the body of the candle. If you are looking to do a trend line analysis and are unsure of how to draw them, check out our aptly titled “How To Draw Trendlines” blog post. The main thing really is ensure that however you draw them, do it consistently. It’s impossible to judge their usefulness to you if you are constantly changing your approach.

Do You Need Confirmation On A Trendline Breakout Trade?

You probably have already figured it out that in order to actually trade a trend line break, you need the line to break. Whether you watch the chart or set some type of alert, you need price to breakout through the top or bottom of the line. The problem occurs when price breaks through with such force that any entry will have a stop that may be too large for either your account or a “worth it” position size.

That’s the problem with confirmation in any trading strategy. You may feel safer in the “knowing” that price is going in your direction but the risk is missing the trade or a smaller position size.

You can bypass the need for the breakout and “front run” the move by using some basic price action trading skills when price is around the trend line.

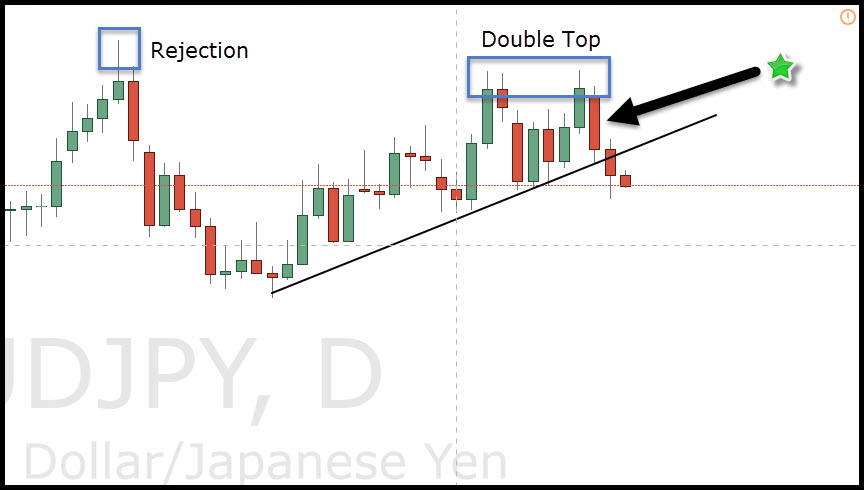

Look at this daily chart of the Forex pair AUDJPY. It’s clear that price wasn’t too interested in more upside at this point in the chart and we even have a double bottom price pattern to help in our decision. Notice the candle that has been pointed out with the green star.

There was no rejection off the line at that candle which is something you would expect if the bulls wanted to regain control of the market. Right?

Since that did not happen, with a little bit of price action knowledge, you don’t have to wait until the breakout to take the trade. Actually, a lot of volatility can take place at points of breakouts and depending on the markets, trading the actual breakout of the trendline could have you suffer slippage with your order.

Assuming you set some type alert during your analysis to warn you of price approaching the line, you can then dial into smaller time frames to see if price is tipping its hand.

Trendline Breakout Potential Revealed

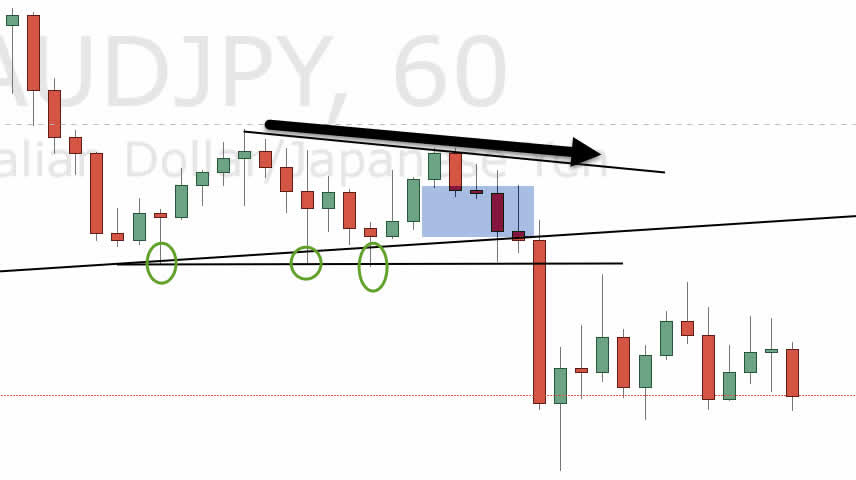

You want to get a better view of the action inside of the candles near the trend line so we are going to dial into the 60 minute chart.

There are multiple tests of support as shown with the green circles on the shadows. Interesting to note is that even with all those attempts, price was not able to rally like it has in the past. You’d want to notice that to aid in your case for a trade.

Price is unable to breach the highs (although I would have loved a failed test of highs to happen there) and price then began to fall. The candles are telling a story especially with the long shadows.

Putting everything together in context therefore building a case for a trade, your trendline breakout strategy could have you placed in a position before the break of the demand line. In the shaded area would be the area to place a trade. A quick test of highs would not invalidate your trade so don’t be that sucker that gets stopped out by using too close of a stop. You certainly want to learn a proper stop placement strategy to keep you away from the noise.

Being positioned early gets you in on the moves that not only breaks the line but also guns stops that are placed by those that are long. You can see that the large red candle did just that to the tune of 50 pips in one single 60 minute candle.

Conclusion

You can get involved in a trendline breakout trade long before the break actually occurs. It just takes expanding your knowledge of price action trading and understanding the action that takes place around the trend line. In doing so, you get involved in the break of support (or resistance) and often times reap the benefits of those traders who get washed out of their position when their stops are hit.

Posted in

Posted in