If you are looking for a ross hook indicator, you will not find it in here. But In here, you will learn how to identify and trade the ross hook pattern.

Many forex traders, especially new traders, at first find it difficult to understand the ross hook chart pattern. But trading the ross hook is easy if you know what a ross hook pattern looks like. You will also get to learn the rules of the ross hook forex trading strategy further below..

Let’s get started…

WHAT IS THE ROSS HOOK PATTERN?

The way to fully understanding ross hook pattern is this: its is a slight variation of the 1-2-3 pattern . Which means in order for you to understand and trade the ross hook pattern, you need to understand and know about the 1-2-3 formation first. Only then you can build up from that and know about the Ross Hook Chart Pattern.

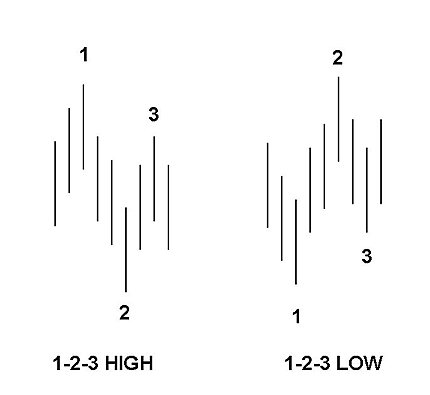

The 1-2-3 chart pattern formations are reversal patterns. There are two types of 1-2-3 formation:

- The” 1-2-3 high” formation &

- the “1-2-3 low” formation.

What’s the difference between the two?

What’s the difference between the two?

- Well, generally, a 1-2-3 high formation forms at the end of an uptrend move: this means that you this is a bearish/sell signal or you should expect the market to move down.

- So this means that the 1-2-3 low formation forms at the end of a downtrend move…so this means this is a bullish/buy signal and you should expect the market to move up.

Now lets talk about the 1-2-3 high pattern formation:

- the point 1 is created when a previous upward movement end and price begins to move down. (the market has to be in an uptrend initially)

- then price moves down to point 2 and then price starts to climb up…

- price goes up to point 3 but that’s far as it can get and starts to fall down again.

- there can be more than one candlestick (or bar) moving point 1 to 2 and again from point 2 to 3.

- when it takes more than 3 candlesticks or bars to form a higher high/low, then this is congestion.

For the 1-2-3 low pattern formation, its the complete opposite of the 1-2-3 high pattern formation.

- point i is created when a previous downward movement ends and price begins to move up (the market has to be in a downtrend initially)

- price moves up to point 2 and then starts to go down…

- price falls down to point 3 but that’s about as far as it can go and starts to climb back up.

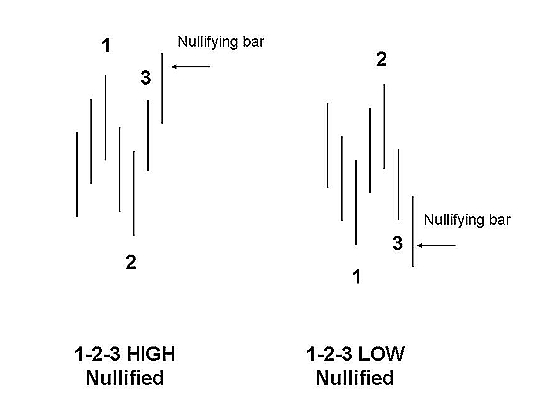

WHEN A 1-2-3 PATTERN IS NULLIFIED

When a 1-2-3 chart pattern is formed, there will be times when:

- price moves above point 1 for 1-2-3 highs

- or price moves below point 1 for 1-2-3 lows respectively.

This means that the 1-2-3- pattern is no longer valid. See example below:

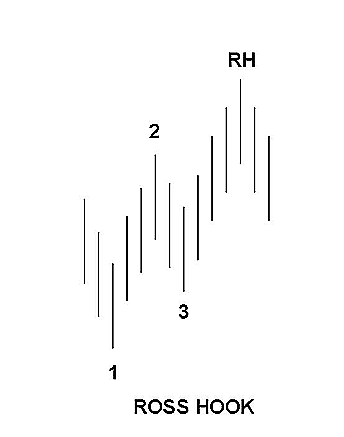

So how does the ross hook pattern form then? Well, here it is:

- the ross hook pattern is formed after a breakout happens on the 1-2-3 high or low formation and a correction happens.

- so in an uptrend market, the price will break past the high of point 2 in in the 1-2-3 low formation.

- the failure of the candlestick/bar to continue going up (which means price goes down again…a correction) creates the Ross Hook!

So in a similar but opposite, is the Ross Hook Pattern for a 1-2-3 high formation:

- the ross hook pattern is formed after a breakout happens on the 1-2-3 high formation and a correction happens.

- so in an downtrend market, the price will fall down past the low of point 2 in in the 1-2-3 high formation.

- the failure of the candlestick/bar to continue going down (which means price goes up again…a correction) creates the Ross Hook!

If you don’t understand, keep going back and read slowly 2 to 3 times…then you will understand Ross Hook.

HOW TO TRADE THE ROSS HOOK PATTERN WITH THE ROSS HOOK TRADING STRATEGY

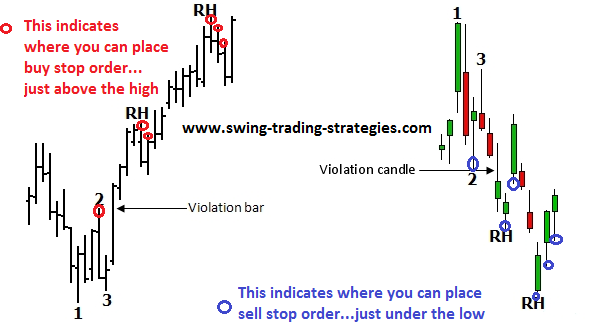

Here is a chart you need to refer to when dealing with the ross hook trading strategy:

This is not a currency pair chart, but its a candlestick chart of the shares of company, say XYZ.

Now, this if for the first 1-2-3 formation starting from the left (refer to price chart above)and here are some things to note about that:

- the market is obviously in an uptrend as can be seen with prices moving above the moving average (the line in the middle and also moving close and within the upper bollinger band line.

- at point 1, you can see that the market make a peak then on the next day, it falls, making point 2.

- then a correction happens-price moves up with a big green candlestick but this candlestick fails to close above the high(or peak) of point 1.

- so now you have an opportunity or signal to short(sell) based only on the 1-2-3 pattern using a sell stop order placed just below the low of point 2.

- however on the 4th day, the candlestick does not fall below so any sell stop pending order place based on the 1-2-3 pattern anticipating a breakout will not be activated.

Now lets go to the 2nd 1-2-3 chart formation…

The next few days, the prices inched gradually up and effectively made the first 1-2-3 pattern null and void because another high peak formed higher than the first point 1.

- Then the next day point 2 is formed and then on the 3rd day, point 3 is formed.

- Price then inches up but fails to go above point 1.

- the 4th day sees a big red candlestick making a breakout down past the low of point 2. If you had placed a sell stop order just under the low of point 2, it would have been activated.

- that red candlestick forms the ross hook because on the next day, its an up day….a green candlestick forms.

- now you know that ross hook has formed, so you place a sell stop order under the low of the ross hook anticipating price to fall back down and activate your sell stop order.

This are examples of sell trade setups but for buy trade setups, you just do the exact opposite.

Another chart to clarify things a bit more about how to trade the Ross Hook Pattern:

That’s how to trade the Ross Hook Pattern.

SOME TRADING RULES FOR ROSS HOOK PATTERN

- The ross hook pattern forms after the formation of 1-2-3 trading pattern.

- In the process of waiting for the Ross Hook Pattern to form, you can actually trade the 1-2-3 pattern breakout as well.

- The ross hook pattern is a breakout forex trading strategy

- Once the ross hook forms, you can either place a pending order just above/below the ross hook pattern to catch a breakout when it happens or…

- Or if after the ross hook pattern forms you need to trail your pending orders above the subsequent highs that form (for buy setup) until price moves back up again and activates your bending buy stop orders.

- Similarly but opposite for sell stop orders: after the formation of ross hook, you can trail you sell stop orders under the lows of each subsequent candlestick that has a higher low until price falls back down and activates your sell stop order.

TAKE PROFIT TARGET OPTIONS FOR ROSS HOOK PATTERN

I have a couple of suggestions here on how you can take profit when trading the ross hook pattern. You may come up with your own ideas on what you think best works for you…but here’s my take:

- measure the distance in pips between point 1 and RH and use that as your take profit target level.

- measure the distance in pips between point 3 and RH and use that as your take profit target level.

- measure the distance in pips between RH and the Correction low (for a buy setup) and RH and correction high (for a sell setup) and multiply those pips by 2 or 3 and that should give your profit target levels.

- Or if you don’t want to place take profit targets then why not trail stop your trades by moving stop loss behind each peak or low point that forms as your trade moves in favour? In a good trending market, this will allow you to ride the trend most of the way and lock in and capture many profitable pips.

HOW TO PLACE STOP LOSS AND TRADING RISK MANAGEMENT

- Use the nearest peaks and lows for your stop loss placement. This way, you have less chance of getting stopped out prematurely.

- Remember, Every trade you place has potential to be a losing trade. So practice prudent trading risk management.

- In forex trading, you need to cut your losses quickly and and trade with acceptable risk like risking only 1-2% of your trading account in each trade.

- In that way, you can always live another day to trade an increase your forex trading account.

Please, like, share, tweet, G+ by clicking those links below. Thankyou.

Posted in

Posted in  Tags:

Tags: