The 10 and 20 SMA with 200 SMA Forex Swing Trading System Is A Very Simple Swing Trading System You Can Implement Without

Any Difficulty At All.

But First Lets Talk about Moving Averages…

WHY MOVING AVERAGES ARE USEFUL

There are two main reasons why moving averages are useful in forex trading:

- moving averages help traders define trend

- recognize changes in trend.

If you see any forex trading strategies that have moving averages in them, the use of moving averages would be pretty much related to the two reasons given.

I don’t want to bother with too many details about moving averages here…so moving on.

THE TWO SIMPLE MOVING AVERAGES(SMA):10&20 SMA’s

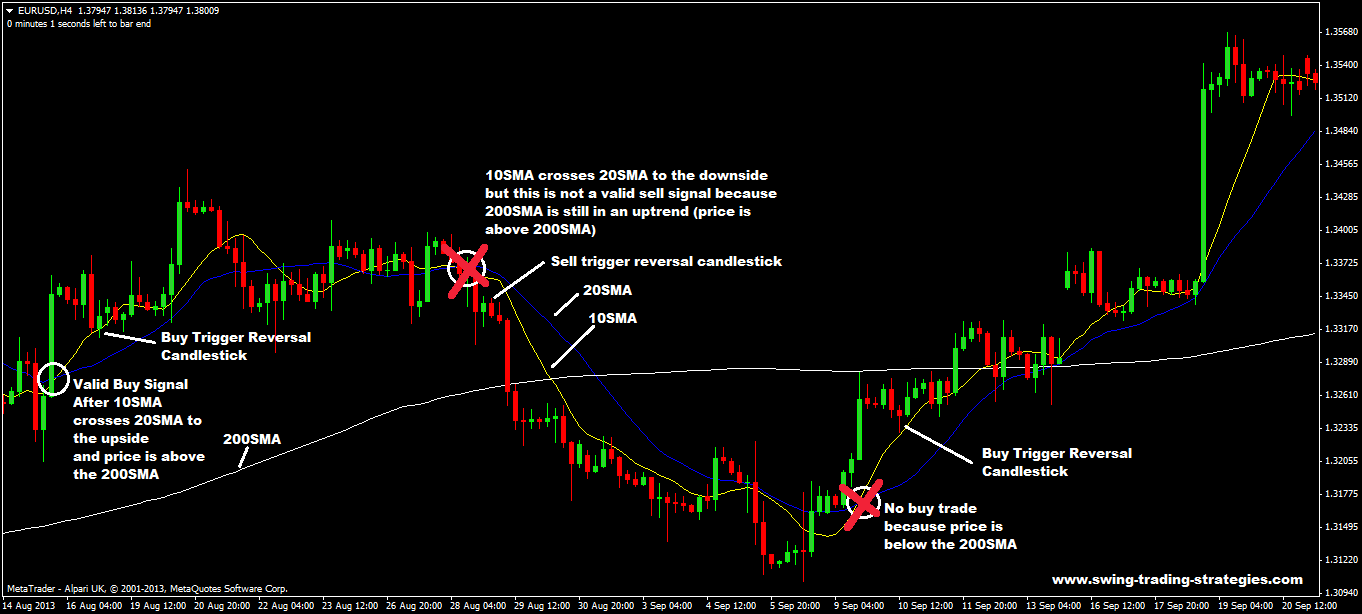

With this swing trading strategy, when the faster SMA, 10, crosses the slower SMA 20, it often signals a trend change.

So when you see 10 SMA cross 20 SMA to the upside then you know there is a great possibility that the market is in an uptrend.

If 10 SMA crosses 20 SMA to the downside, then you know there is a great likelihood that the market is in a downtrend.

The 10 and 20 SMA with 200 SMA Forex Swing Trading System Trading Rules

- Trading Timeframes: Stick to 4hr timeframe and the daily Timeframe.

- After the faster 10 SMA crosses the slower SMA 20 look for these reversal candlesticks to enter your trade

- For Selling, look for bearish reversal candlesticks and place sell stop order 5 pips under the low of that bearish reversal candlestick for buying, look for bullish reversal candlesticks and place your buy stop or buy stop order 5 pips above the high of that bullish reversal candlestick.

- Place your stop loss above 5 pips above the high of the entry reversal candlestick if you are selling and 5 pips below the low of the bullish reversal candlestick if you are buying.

- Set your take profits to 3 times what your risked or look for previous swing high/lows and use these price levels as your take profit target.

How To Use 200 SMA With This Forex Strategy

Now as an added measure to ensure you only trade with the main trend, the 200 SMA can be used a further filter.

- if 10 and 20 sma are above the 200 SMA only take long positions.

- if 10 and 20 sma are below the 200 SMA only take short positions.

This ensures you take trades only based on the significant or main trend which 200 SMA gives you an indication of.

Did you enjoy this? It would mean the world to me if you shared it:

Posted in

Posted in

What do you think about take profits at the cross of the faster ma back in the opposite direction? And in all the ma cross swing strategies.?

Hi Olus,

you can try that and see how it works out.

the problem with that though is that if there is very big price move, most of you profits can be wiped out.

Regards

Mangi