The 20 pips Asian session breakout Forex trading strategy allows you to trade breakouts upon the the opening of the London trading session.

What is so special about the time when the Asian session dies off and the London session begins that there is a system called Asian session breakout?

In general, the Asian session is a quiet time to trade.

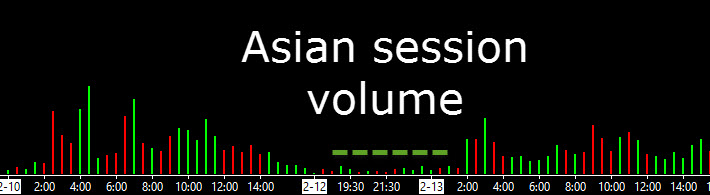

There is no central exchange for Forex so getting the exact volume is difficult. As a proxy, let’s look at the volume for the JPY currency Futures contract.

Asian Session Volume – 2017

You can see from the dashed green line the volume in the JPY is well below the trading day and often times this is simply price moving in a small range (but not always). You can see the spike in volume once London opens up and that is where we look to get some pips added to our trading account.

It’s during this slow time in the market that we can look to perhaps position for the London open and use our 20 pips a day trading strategy for a quick pop trade. You can visit the Oanda Forex Market hours page here.

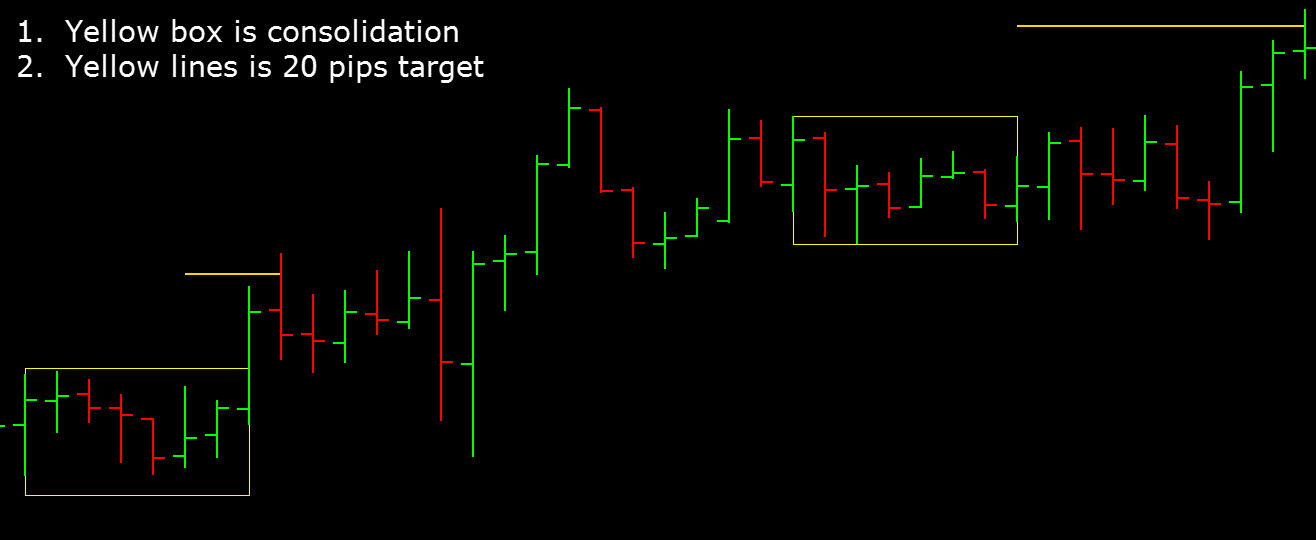

20 Pips A Day From These Asian Session Ranges – Jan 2017

Breakdown of 20 Pips A Day Trading Strategy Using Asian Session Breakouts

This Forex system is similar to the London breakout forex trading strategy but the only difference here is you are aiming for only 20 pips profit for every single trade you place.

- Currency Pairs to Trade: GBPUSD, GBPJPY, EURGBP, EURJPY

- Forex Indicators: None

- Time frames: You can use 15, 30 mins or 1 hr time frames.

As discussed earlier, the Forex market during the Asian trading session is usually thin and does not much volume and volatility. Because of this, you will generally tend to see the Asian market in a consolidation (price compression).

But as soon as the London and European Forex market opens, the volatility and the volume increases and this causes price to breakout of the Asian session market consolidation.

This Asian Session Breakout Strategy is designed to capture that breakout.

Refer to this Forex chart below when you go over the rules of this breakout trading strategy. It is the 1 hour chart of the USDJPY currency pair.

TRADING RULES

The trading rules for the 20 pips Asian trading strategy are really simple:

- At least 1 hr before the London market opens, you need to identify the highest high and lowest low of the Asian trading session. You can see that I have done that with the yellow boxes. The ideal situation would be that the Asian session was traveling in a tight range during that day. If the Asian session was in a good trend and not in a consolidation during the day, then if you tried to find the range, it would be too large…which means your stop loss would have to be very large to cater for that wide range! So only target days where you really see tight trading range during the Asian trading session.

- Place a buy stop and sell stop pending orders at least 2-3 pips on both sides of the consolidation. Some of you may choose to pick a direction depending on the move into the consolidation.

- The stop loss of the buy stop order should be placed 2-3 pips below… on the other side where the sell stop pending order was placed and the stop loss for the sell stop order should be placed 2-3pips above the highest high of the consolidation…where the buy stop order pending order was placed.

- Set take profit targets for both pending orders at 20 pips. You can see the 20 pips a day being taken at the yellow lines.

- Wait for a breakout to happen.

- When one of the pending orders is activated, then immediately close the other other that has not been activated.

20 Pips A Day Or More? Test This Asian Breakout Strategy Before Using

Many traders just jump into a trading strategy like the 20 pips a day one without doing any sort of testing. They will ask questions about other currency pairs to use, extended profit targets…etc…but won’t do what needs to be done to answer those questions.

With every trading strategy on this site, you must do your own testing and this Asian session breakout strategy is no different. 20 pips a day over time can make for a nice healthy trading account.

Posted in

Posted in

Does this strategy works only on a Major pair (EU, GU ect)? Or is it applicable to all pairs?

Raiwin,

its worth testing out..because when the london market opens, it also means the other major pairs start to move as well so yes, it can be applied to any currency pair that shows the characteristic of breaking out of the Asian session tight range.

Hi Mangi,

does this strategy only when no fundamental news are released on that day?

Just to confirm, is the London open at 8am (U.K time)? and during daylight saving time its 9am?

Hi Nelson,

(1) Its better, I suppose, to use this system when no news are scheduled to be released that day. But if you take a trade and if any news releases are going to be made that day, then maybe take some or all profit or of you move move stop loss to breakeven and see what happens…the news may work in your favour.

(2)yes, london market opens at 8am UK time.

if you don’t know what time london forex market opens in your timezone, refer to this:

http://forex.timezoneconverter.com/

Cheers

Mangi

okay thanks for the previous reply,

Your Quote on rule number 1 :

“So only target days where you really see tight trading range during the Asian trading session”-

quote. Based on this quote, any good indicator which is reliable so that it can tell you if its ranging or in trend ? Such MACD? RSI? or other tools ?

By observing the range of Asian Session, are you looking at the whole day (hourly chart) time 8am tokyo to 4pm tokyo time or just only the last closing hours of tokyo?

thanks

Hi Mangi,

Can the EUR/USD be used here?

you have not replied any of my questions, why is that?

Hi Nelson,

I don’t spend all my time answering questions immediately as I have other things in life to do.

Anyways, you questions and my answers/thoughts:

(1)Based on this quote, any good indicator which is reliable so that it can tell you if its ranging or in trend ? Such MACD? RSI? or other tools ?

Answer: i don’t know of any reliable indicator. Price action gives you much more clarity than any other indicator in my opinion when you want to determine such things.

(2)By observing the range of Asian Session, are you looking at the whole day (hourly chart) time 8am tokyo to 4pm tokyo time or just only the last closing hours of tokyo?

Answer: Refer to rule #1 up there….this is a daily trading system. which means you potentially make only one trade a day IF the conditions are good to trade (tight range).

(3)Can the EUR/USD be used here?

Answer: i think it can work but you need to go back over past data and do a study/analyse to see if it can work.

(4)you have not replied any of my questions, why is that?

Answer: refer to my second sentence on this reply…:)

Cheers

Thanks for the great help you are giving to traders.

Could you tell us in your own opinion how many pips you will consider too large a range to trade this Asian Break out strategy?

Olus,

that will be a hard question to answer (because its not going to be the same all the time) but if you have spend a lot more chart time understanding and seeing how the market moves in the different trading sessions (asian, london, us etc) then you will get a “feel” of the asian trading range is like and if its too large for you to take the trade or not.

cheers

Mangi Madang