The London Breakout Strategy is an easy to use trading strategy designed to take advantage of the sudden increase in trading volume that takes place near the London Open.

If you are able to draw a few horizontal lines on your chart and can be awake during the trading hours for the London session, let’s get started on how you can profit from the superior trading opportunity breakouts during the London trading session can be.

What Time Is The London Trading Session

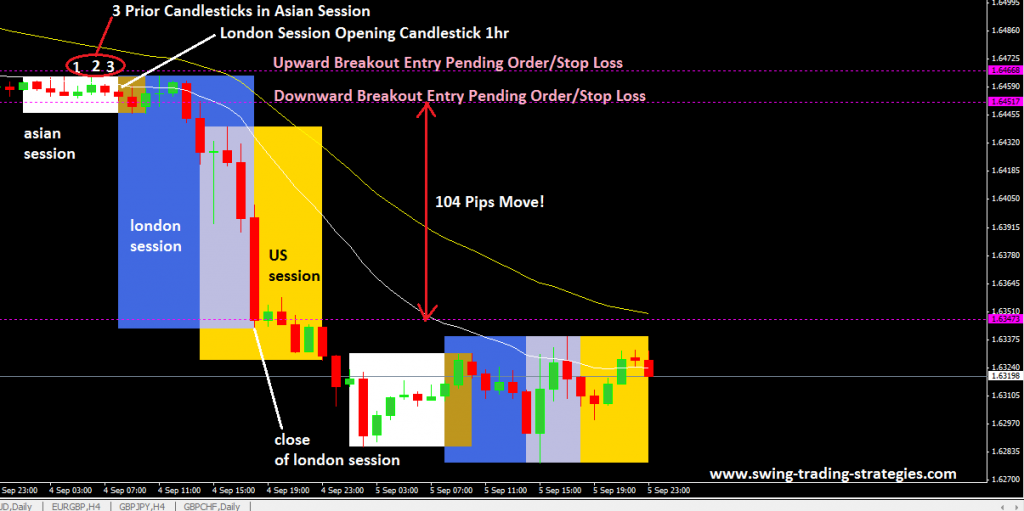

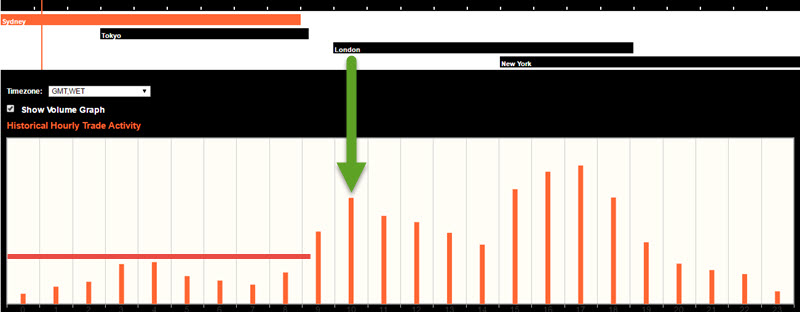

You can see from this chart that the London trading session, as noted by the green arrow, has much higher trading volume than the Asian trading session to the left. This is 3:00 a.m. Eastern time.

We are looking to take advantage of the range bound market that occurs during the Asian session. The London open should see a spike in trading volume and we want to get involved in a trade during this time.

Now, we don’t know which way the range bound Asian market will breakout during the London session. What we do know is that when the Forex market opens in London, we will get an increase in trading volume.

The London Breakout Strategy is a momentum trading strategy that uses the coiled up energy from the Asian session. It’s no different from other Forex breakout strategies in that regard but the difference is “when” we use this particular strategy.

What Do You Need To Trade The Breakout At The London Open

There are no special trading indicators needed to trade the breakout at the London open but we do have a time frame we like to use.

- Time Frame: One hour Forex chart

- Currency Pair: GBPUSD. You can experiment with NZDUSD and EURUSD

- Risk: Use proper risk management

- Indicators: None required. You can use this MT4 indicator that highlights the different trading sessions.

While there may be a few variations of the London Breakout Strategy, this is the simplest version that requires very little of your time.

How To Trade The London Breakout Strategy: Rules

Since we are usually coming into the London session in a range, we already have an entry point due to that range.

- the London open, draw a support and resistance line around the last 3 candlesticks that formed in the Asian session for the GBPUSD

- Place a buy stop order 2-5 pips above the resistance zone

- Place a sell stop order 2-5 pips below the support zone

- Once an order is triggered, immediately cancel the other pending order

- Place your stop loss order in the location of the previous order

How To Manage Your Long Or Short Trade

There are couple of options for managing your trade and here are some suggestions only which you can use or you can decide to come up with your own, its up to you:

- At 1 times your risk, move your stop to break-even. This is to ensure you do not take a loss on a trade that has shown intent in your desired trade direction

- Use a trailing stop technique by trailing by “x” pips when price move by “x” pips or some similar variation like, trailing it by “x” pips when price moves by “2x” pips

- Use a profit target such as 1-2 ATR or previous support or resistance zones

- Close the trade prior to the U.S. and London trading session overlap

Asian Session Range Is Too Large

One problem you may face is having too much volatility during the Asian session that has caused a trading range to be “too wide”. Too wide is subjective but think in terms of ATR.

ASIAN RANGE FOR LONDON BREAKOUT STRATEGY

You can see the difference in ranges on this chart. Some things to keep in mind when looking to play the breakout of the range:

- Look for orderly price action

- Take note of the long shadows. You may elect to ignore them and just use where the majority of price is contained during the entire Asian range

- Look for consolidating near either support or resistance as this could tip you off to the probable breakout during the London open

What Are Some Of The Advantages To This Breakout Strategy?

- Simple forex trading system

- No indicators

- This is a price action trading system

Drawbacks To Trading Breakout Of The Open

- You could get caught in a bull or bear trap

- Monday and Friday can cause some odd price action during both the Asian and London session. Be mindful of the days you will trade

I know some of you will probably want to use some indicator for this trading method. You don’t really need to but if you are going to, you can download this indicator blueprint for free which will tell you how to use some of the most popular indicators around.

Posted in

Posted in  Tags:

Tags:

Can I use this strategy on other currency pairs

Hi Mani,

I think you can but here’s the problem with using the london breakout fx strategy with other currency pairs: there is less movement of other currency pairs in that same period compared to GBPUSD pair.

You see, when the london forex session opens, it is actually a very huge market and the currency pair that see the most movement is GBPUSD pair.

That’s why its best to use GBPUSD with this forex strategy. That’s just my thoughts.

Regards

Mangi Madang

Do you have a video on the “London Session Breakout Forex Trading Strategy”? I learn easier by watching video as I am an Epileptic and my disability permits me to learn easier by video lessons.

Thank You,

Jason

Hello Jason,

mate, sorry I don’t have any video on this system. There are couple of videos on youtube that come close to this system you can check out:

https://www.youtube.com/watch?v=OCDguq72zog

https://www.youtube.com/watch?v=2KuVpUdlvhw

Hope this helps.

What happens when the price keeps trading in that range? My trade triggered at the buy stop but then the price went down hovering close to the stop loss.

If during the london session, price is still in withing the tight range and does not breakout out, consider cancelling both your pending orders and wait for the next day.

If one side order is activated, that means you are in so regardless if the price is hovering near your stop loss, you’d better let the market do its job.

Many times, traders fear of suffering a loss makes one bail out too soon with a small loss and only to realize the futility of this mistake when price shoots in the direction they where hoping for in the first place!

Mangi Madang

What is the success rate of this strategy?

Olus,

that is something you have to figure out yourself either by live testing or backtesting.

all trading strategies posted on this site do not necessarily come with success rates etc etc etc..its really up to the user to figure out and test them out to see if they work for you or not.

cheers

Mangi Madang

Hi Mangi

When is the Close of the Asian trading session in GMT time?

I’m in South Africa and want to apply the strategy well.

Regards,

Nathi

Hi Nathi,

GMT fx market closing hours for Asia:

Tokyo 9:00 am

Hong Kong 10:00 am

Hi Mangi,

So you draw your lines based on H/L of the 3 candles before the London Open candle, and as soon as London opens you get in with your pendings either way.

Do you get out before NY opens? NY goes in reverse of London quite often…

Thx!

Hi Dan,

with your fist statement/question, the answer is YES. What you are trying to do it use those pending orders to capture the breakout in either direction.

with your second question, I suggested above that “Close your trade at the end of the London session”. The reason? One reason is, I believe You’ve figured it out already when you said this statement: NY goes in reverse of London quite often…

But at the end of the day, its up to you how you want to exit a trade.

Cheers

Mangi