Hello Traders,

these are the forex trading signals/trade setups that I’d be watching this week.

- Some trade setups are forming in the larger timeframes whilst others are on a much smaller timeframes like the 4hr.

Remember, trendlines, support and resistance levels are not lines drawn in concrete, price can break them.

The secret is to watch price action when price touches(reaches) these levels to see if there is a signal for a “bounce’ before you buy or sell and you do this by using these reversal candlestick patterns.

- if you can’t read the comments on the charts clearly, then click on the image to enlarge so you can read.

#1: EURAUD Sell Trade Setup

- There’s a potential resistance level as can be seen by the blue line shown on the chart below.

- if price reaches this line, I’d be switching to smaller timeframes like the 1hr to watch for bearish reversal candlesticks to go short.

- If price hit this resistance level and moves down, note on the chart below that that there’s a major upward trendline you’ll have to watch for as well, which can have price bounce up from there…(this will be a buy setup happening and may not necessarily happen this week)

#2: EURGBP Buy Setup on An Downward Channel Pattern

- Price is very close to the lower channel trendline and may touch it this week.

- Note also that there are no major support levels to be seen nearby so this lower trendline may provide a temporary rally for EURGBP which has been in a free fall for the last two weeks (seen from the weekly timeframe).

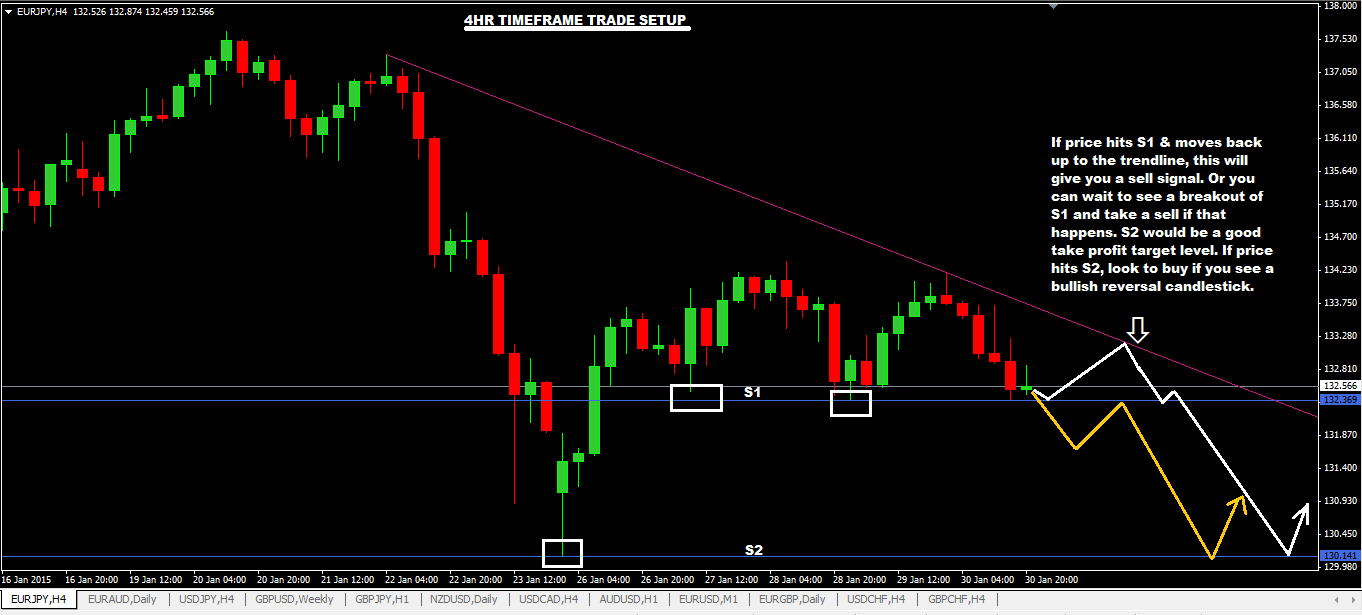

#3: EURJPY Sell Trade Setup

- When you look closely at this setup, this is a descending triangle formation happening…downward trendline and the blue support line, S1 so this is a bearish signal.

- Three thing can happen, price breaks the S1 and heads down or hits S1 and moves up to the trendline and then bounce back down or trendline is intersected and price moves up…but the overall trend the daily/weekly timeframe is still bearish so really look for an opportunity to go short instead of buying.

#4: EURUSD Sell Trade Setup

- This is a downward channel pattern forming similar to EURGBP setup mentioned above.

- watch the price action if and when price hits the lower trendline and if you see an upward bounce (bullish signal) then go long (buy).

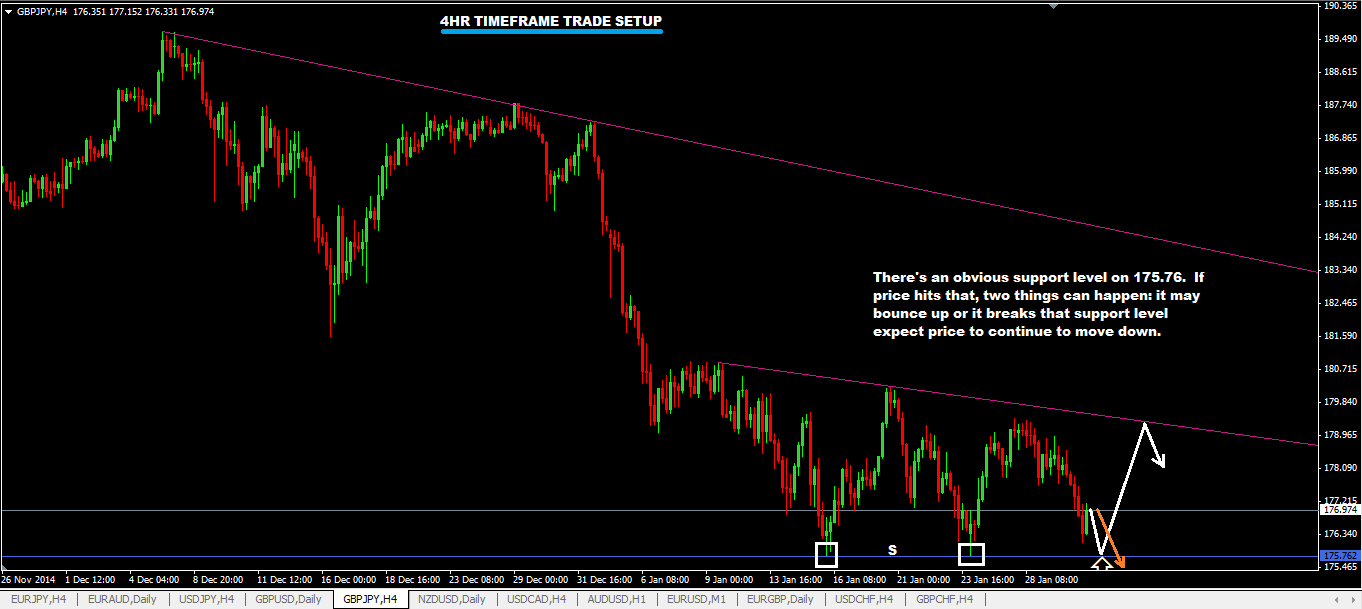

#5: GBPJPY Buy Trade Setup

- Note the obvious support level on 175.76

- Look for bullish reversal candlestick if price hits that support level…this should be your signal to buy.

#6: GBPUSD buy Trade setup

- see commentaries on the chart itself.

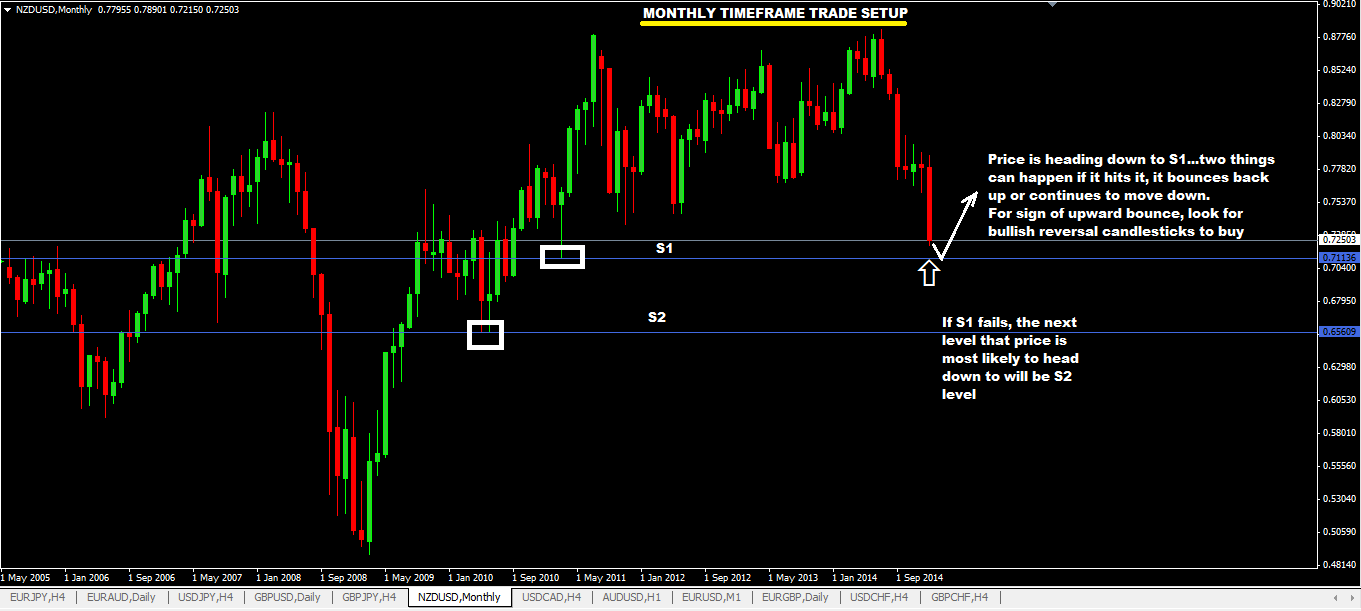

#7: NZDUSD Buy Trade Setup

- now, NZDUSD has been on a free fall last month (Jan 2015) as seen in the monthly timeframe below.

- there are two support levels, S1 & S2 to watch out to see if price reacts to these. The first of these would be SI.

- Price is very near to S1 so watch that level.

- See other comments on the chart itself.

#8: USDCAD Sell Trade Setup

- Major resistance level on 1.3057 and price is heading up to it.

- watch for bearish candlestick to go short if price hits it and shows weakness.

HOW WOULD YOU TAKE A TRADE THAT FORMS IN A LARGER TIMEFRAME?

This is how I do it:

- I switch to a much smaller timeframe and wait there for better trade entry. For example, if a setup is forming in the weekly, then as price nears a support, resistance or a trendline etc…then you need decide what would be the best timeframe to “zone in/zoom in” so that you can get a better trade entry.

- I prefer the 1hr for trade entries but you can use the 4hr timeframes as well for trade entries.

- My stop losses are placed above/below levels of significance which can be support & resistance levels and trendlines or a high/low of the reversal candlestick which I used as my signal for trade entry.

- For profit targets, if a sell order, I use support levels or previous swing lows. For buy order, resistance levels and previous swing high points are used.

- How I use trailing stop: for a sell order, I move and place it behind the lower price peaks as price continues to move down until I get stopped out or my take profit target is hit. For a buy order, i do the opposite: move trailing stop and place below the troughs that form as price continues to move up.

Nothing complicated.

WHAT YOU SHOULD KNOW ABOUT THESE KINDS OF FOREX TRADING SETUPS

- Forex Trading setups that form in the larger timeframes can move for hundreds, if not, thousands of pips. If you don’t believe me, check this trade alert I gave out on EURJPY in which I managed to get a small profit (145 pips only) of that huge move down (1900 pips move). …just open up your EURJPY chart and check out where the alert was given and where is the price right now? This is an example what I’m taking about.

- The risks for taking this kinds of trading setups are small in comparison to the profit you can make…in other words, the risk to reward ratio of these trades setups are really good if trade works out as expected. But if you lose, you will lose a small amount(if you don’t risk too much per trade!)

REMINDER!

Please don’t forget to share and tweet by clicking those buttons below. Thanks.

Posted in

Posted in

hey man! great website. i always follow yr week by week analysis. keep up a good job.

anyway, i want to know if you could help me to differentiate between fibonacci retracement or reversal?

i use this method for market entry, http://www.dukascopy.com/fxcomm/fx-article-contest/?Fibonacci-Trading-Strategy-Part&action=read&id=629

very profitable trading strategy but yet i have a few problem using this strategy. (because i dont know if trend is retracement or reversal?)

glad if you could help me by explaining me how to fully utilize this method.

Michael,

my understand of fibonacci retracement is this:

In a downtrend (for example) if price moves from A to B. And then from B it moves UP to say 38.2 fib retracement level and then MOVES back down to continue in that existing downtrend, that is an example fibonacci retracement. We say that price retraced from 38.2 fib level.

So whats a reversal then? The root word for reversal is ‘REVERSE’ isn’t it? So in the example above, where did price reverse from? From the 38.2 fib level. Which is off course the fibonacci “RETRACEMENT’ level.

First, you need to know if price is in an uptrend or a downtrend. You can use price action structure to determine that (if you don’t know how, click this link) or you can simply put a moving average like 7 or 14 ema and that should give you a clear visual if the market is an uptrend or downtrend.

In a downtrend, market has a tendency to rally back up and thats where you start using fibonacci retracmenet levels to see if reversal happen when price hits those levels. The same but opposite happens in a uptrend market: price will fall back down and then move back up in the direction of the original trend which is UP.