Hello Traders,

today, I’m going to show you a very simple technique I use to place pending orders on diagonal trendlines. This is a manual technique (Chart Examples on how to do it shown below…scroll down). Now, this process can be simplified using an expert advisor which you can research to see if there are any free ones out there of if not then hire a MT4 coder to create one for you.

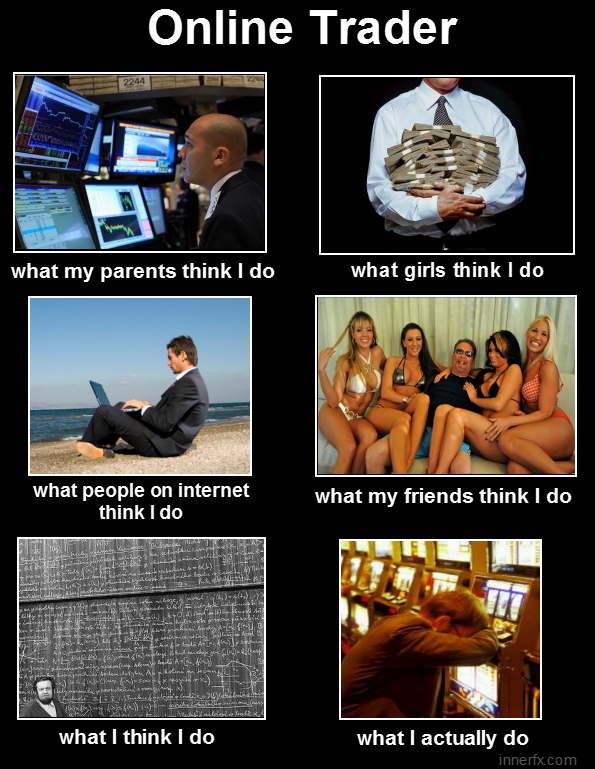

But before I get into the details of that, for those you who are regular readers and visitors to swing-trading-strategies.com, you know, my website is all about sharing free forex stuff and once in a while, i share some funny stuff as well…like this:

You’ve got to have a laugh once in a while. Believe me, its a stressful environment so having a few jokes and having a good laugh is essential too keep your sanity 🙂

TYPES OF PENDING ORDERS IN FOREX

Now, if you are using MT4 trading platform, there are 4 pending order types you should know:

- Buy Limit Pending Order

- Buy Stop Pending Order

- Sell Limit Pending Order

- Sell Stop Pending Order

Here’s the difference between each:

Buy Limit->A buy limit pending order is placed below the current market price so if price heads back down and hits the pending order, it will activate a buy order.

Buy Stop-> A buy stop pending order is placed above the currency market price so if price goes up and hits it, a buy order is activated. It you want to trade the breakout to the upside of resistance levels, or highs of candlesticks a buy stop pending order is what you use.

Sell Limit-> A sell limit pending order is placed above the current market price. If you place a sell limit pending order, then you are waiting for price to head back up to hit that order and activate a sell order.

Sell Stop->A sell stop pending order is placed below the current market price. So a sell stop pending order is essentially a breakout sell pending order to capture further downward move of price. If you want to trade the breakout of support levels, or breakouts of the lows of candlesticks, then sell stop pending order is what you use.

There are the only 4 pending orders available in MT4 trading platform. I’m not familiar with other trading platfroms so really can’t make any comments on those.

Advantages of Pending Orders

If you have a day job or you don’t have time to sit and watch your trading sceen, then using pending orders in forex should form your set-and-forget type of trading strategy which you can use. All you do, is set your open pending orders at the price level you want to get into a trade, set your stop loss and take profit targets and you can walk away. Job done.

THE PROBLEM: DIAGONAL TRENDLINE ANGLES

Can you pick the exact spot where price is going to hit a diagonal trendline and bounce up or down from? No, its impossible. Because its at an angle. You really have to be sitting there and monitoring the price movement to actually see it touch the diagonal trendline to take a trade.

This is the problem: price moves up and down VERTICALLY and forms simple horizontal levels of support and resistance, pivots, fibs etc. But the diagonal trendline, is at an angle so price is not “fixed” like in the horizontal level.

This chart below, shows you the problem:

Now, what I’f you are not there watching that diagonal trendline?

That’s the challenge I’ve faced with trying to place pending orders based on diagonal trendlines, especially when trying to use sell limit and buy limit orders on diagonal trendlines.

Because, here’s the thing: I’ve been in situations where (for example) I had to pick up my daughter from school just when I see that a forex trading setup I have been watching closely for over a month is now about to come to fruition and that trading setup is based on a diagonal trendline!

What should I do? Should I let my child wait for me alone at school while it may take me heaven-knows-how-many-minutes before I go pick up my child after I place my trade?

You know what? If I did that. That would cause a bloody “war “that would be greater than George Bush’s Iraqi War when my missus finds out and there won’t be any more strange movements under the bed sheets at night for a very very long time! (Sigh!). Heck, I’d be forced to sleep in the couch for sure!

Now fun aside…

You see, I don’t have any expert advisors to set to take the trade on my behalf while I’m gone. Placing pending orders on diagonal trendlines is really a wild guess at best because its at an angle and you really don’t know at what level, price is going to go to ensure your pending order gets filled.

Now, that’s not the case with placing pending orders on horizontal price levels. It’s very easy.

THE SOLUTION

Now, this is not the perfect solution, but it has worked fairly well for me. There’s a little bit of guessing involved.

Here are the steps:

Step1: Draw your diagonal trendline

Step 2: Draw a vertical line which will be in line with the ‘current candlestick” that is forming and make a mental note of how far away price is from the trendline and ask yourself this question: how many candles after the current candle do I think price is going to hit or touch this trendline?

Is it 2 or 3 or 4 candles later?

Step 3: Based on your answer, drag the vertical line you drew in step 2 to the the place where you think the future candlestick will hit the trendline. This vertical line will intersect with the diagonal trendline. Remember, this future candlestick has not formed yet. You are doing a future price projection.

Step 4: If price does not hit the trendline, keep repeating the process and adjusting your intersection price until your pending order is activated.

FURTHER NOTES:

- make sure price is closer to the trendline (because there will be a greater chance of touching it by a few more candlesticks later) before you do this. If price its too far away, you’d be wasting your time.

- I tend to pick the future candlestick that is a lot further away from the “current candlestick” just to ensure that price has a greater chance of touching the trendline( and activating my pending order )then the one close to the current candlestick.

- So I may be picking the 3rd or the 4th candlestick instead of the 2nd one (in the example above).

Don’t forget to click those buttons below to share and tweet if you’ve enjoyed this forex article on pending orders and how to use them on diagonal trendlines. I’d be really grateful for that.

Posted in

Posted in