Moving average crossovers are a popular method of approaching a trading strategy. You can use long term exponential moving averages to take advantage of a “macro view” or short term averages such as the one discussed here, 5 EMA And 8 EMA.

The short term moving averages crossing over indicates the short term trend has changed and we want to trade in the direction of the cross. If the 5 is above the 8, we will look for long trade entries. If the the 5 ema is below the 8 ema, we will look for short trades.

Keep in mind this is a short term swing trading strategy so keep your profit expectations in check.

5 EMA And 8 EMA Trading Strategy Details

Timeframes: 4hr/daily

Indicators: 5 ema & 8 ema

Currency Pairs: Any

Long Entry Rules: Wait for 5 ema to cross 8 ema to the upside. You can buy stop the high of the candle that turned the moving averages or simply enter at close.

Short Entry Rules: When 5ema crosses 8ema to the downside, you can sell stop the low of the candle that turned the moving averages or simply enter at close.

Stop Loss: Set your stop 5 pips above or below the entry candlestick. If that entry candlestick is a narrow range candlestick, use the previous candlestick.

Take Profit: You can use a couple of options for take profit

- Look to the nearest chart structure

- Use a cross of the moving averages

- Use a reversal chart pattern to signal your trading exit.

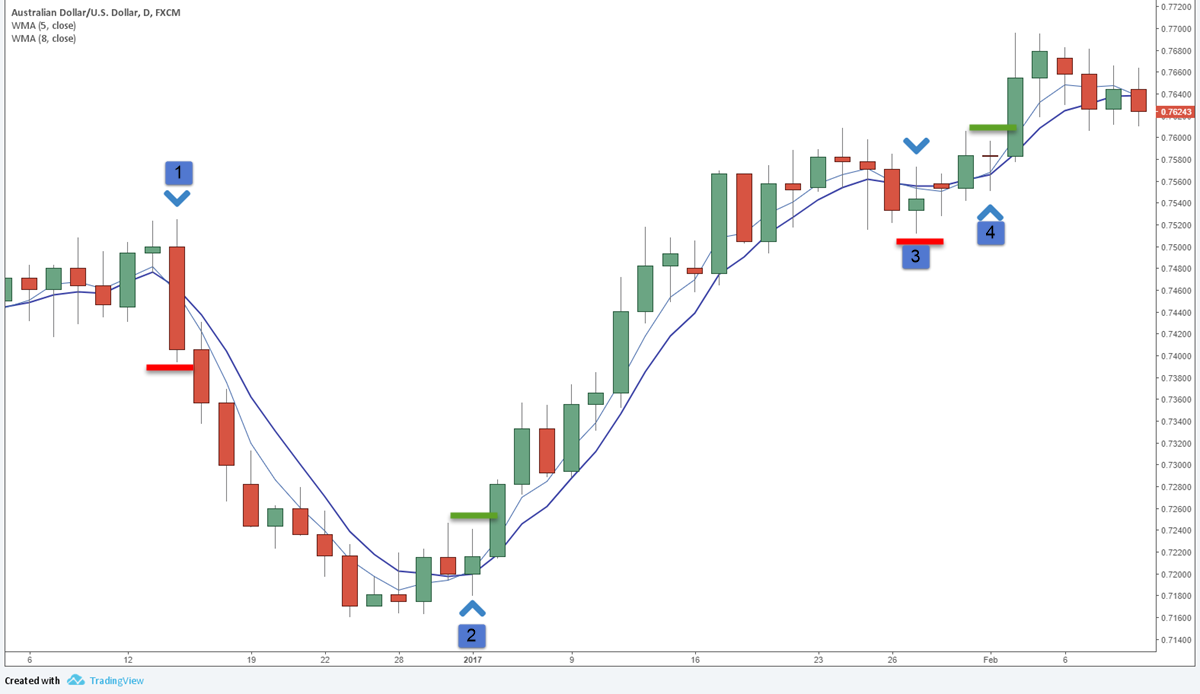

This is a daily chart of the AUDUSD with our 5 ema and 8 ema moving averages applied.

- I am using the conservative entry of setting a sell stop below the low of the setup candlestick. If you used the moving average crossover as an exit and exiting at the close, this short trade banked 178 pips or a 1.38R

- You can trade as an “always in” trading strategy and this trade sets up with a spinning top candlestick but you are triggered in on a momentum candlestick. Using a resistance structure (see #1), this trade banked 256 pips (2.4R). Using the crossover at 3, the pips total 298 pips. Fibonacci 1.272 profit target 376 pips or 3.5R

- This short trade does not trigger as price never passed the low of the setup candlestick.

- Triggered long but trade appears to be in danger of taking a close upon the cross of the moving averages

As you can see, the 5 ema and 8 ema crossover trading strategy is pretty straight forward. As you gain experience, you will tend to use other tactical trading plays or trading strategies (breakouts, pullbacks) to enter the trend if you missed the actual crossover trade trigger.

Manage A Profitable Trade

How would you manage a profitable trade placed with the 5 ema and 8 ema crossover swing trading strategy if you are looking for higher returns?

- If trade moves in favor, and you want to lock in profits, the best option is to move stop loss and place behind the high(or low) of each subsequent candlesticks that forms. That means for a short trade, move stop loss and place above the high the candlestick that continues to make lower highs.

- For a long trade, move stop loss and below the low of each subsequent candlestick that continues to make Higher Lows.

- Or if on the daily time frame, you may try to use a 50-80 pips trailing stop.

- If on the 4 hr time frame, use 25-40 pips trailing stop.

- Use an ATR trailing stop

- Use trading stop placement tips from this article.

Good (and bad) of 5 EMA And 8 EMA Cross Over Swing Trading System

- Easy to understand and implement.

- In a strong trending market, there is potential to make a lot more profit when you ride out the trend with good trade management.

- This trading strategy would give a lot more false signals in a ranging market (which you can also trade)

- Stop loss can be quite big depending on the time frame that is used so you need to adjust your position sizes to bring your trading risk to an acceptable level.

- Moving averages are lagging indicators and every entry taken based on this swing trading system is effectively “late”. This means that price had already made a big move and you would have not gotten into the trade at the start of that move because the entry of the 5 ema & 8 ema trading system is based on lagging moving average indicators.

Posted in

Posted in