The Bloomberg trading terminal polled it’s users and the most used trading indicator was the RSI, the relative strength index.

The RSI trading indicator is a measure of the relative strength of the market (compared to it’s history), is a momentum oscillator and is often used as an overbought and oversold technical indicator.

To explain oversold and overbought:

- If the momentum in price movement is increasing to the upside, an over extension will lead the oscillator into the overbought zone, generally the 70 level. It’s at this point, theoretically, the traders will see the extension in price and begin to unload long positions. At this point as well, counter trend traders will look to short the market.

- If price momentum is to the downside, the RSI can reach the 30 level and at this point, theoretically, traders will see a market that is oversold and sellers will look to take profits. Other traders with other methods and thoughts about price will look to buy into the market.

The RSI was created by Welles Wilder and many trading strategies have been designed around this indicator. From trading oversold and overbought levels to trend determination via the 50 level, the RSI momentum indicator makes up the backbone of many different types of strategies.

For our trading strategy, we are going to use the RSI along with the 20 period simple moving average (SMA) and is great as a swing trading strategy for Forex and other markets. If trading Forex, this trading strategy can be used on any currency pair that is actively traded. Generally, I still with the majors and add in a few others such as EURJPY and GBPCHF.

We Need A Trending Market

This trading strategy will rely on a market that is trending. There are trading strategies for non-trending markets but for this, we want to latch onto a move that leads to a large potential swing trade.

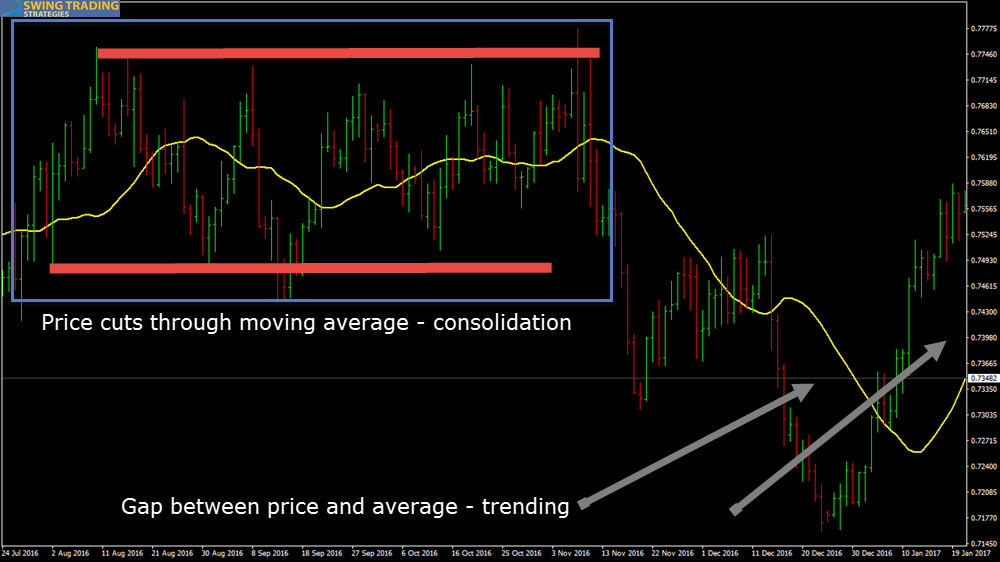

We can use structure to determine the trend but for a quick and dirty trend determination, we are going to use the moving average in two ways:

- If price movement is cutting back and forth through the moving average, we will consider that to be a range bound market.

- If there are gaps between the moving average and price, and price is predominately on one side of the average, we will consider that to be trending.

Note that after you have objectively identified a market that is ranging, you can often mark of the support and resistance levels of the range. When price breakouts out of that range with strength and conviction, you may start looking for trending price action.

You can often see the momentum candlesticks breaking from either the support or resistance level that which will tip you off, using price action, that the range is completed.

Moving average can highlight trends and consolidation

You can see in this graphic that when price chops back and forth through a moving average, you are looking at a market in consolidation. That’s not a bad thing if you are looking for break out trading opportunities with your trading system.

A gap between the moving average, in our case the 20 SMA, we are looking at a market that points towards a trending market and is what we need to see for this trading strategy.

You can use other technical analysis measures to determine a trending or ranging market however price that is not making a trending price pattern, is generally consolidating.

Trending Market But Uptrend or Downtrend

The 20 SMA with RSI swing trading strategy in a trending market has the potential to add hundreds of pips to your count. This is especially true on the higher time frames, four hour and above, as smaller time frames can change their trend direction state more often.

I have always preferred daily charts for swing trading positions:

- There is less random noise in the higher time frames

- News events that cause large moves on smaller time frames often don’t make a dent on the larger time frame

- I can hold traders longer and not get knocked out of a trade too early

- Position sizing is important as stops are usually larger.

As a Forex trader, you are looking at some of the best trending markets available. This is a great strategy to take full advantage of that fact.

Is this method suitable for day trading?

If you have time to sit at your computer and have identified a trending trading session, you may want to test the RSI trading system to see if it fits you as a day trader. I find day trading to be a J.O.B., more prone to random price movements, and trading costs can add up.

How do we determine what direction our trend is?

We will use a very simple determination for trend direction and that will come via the relationship between price and the moving average. Note that I also prefer to see a slope in the moving average

- when the price is above the 20 sma the market is in an uptrend.

- when the price is below the 20 sma the market is in a downtrend

RSI Indicator Settings

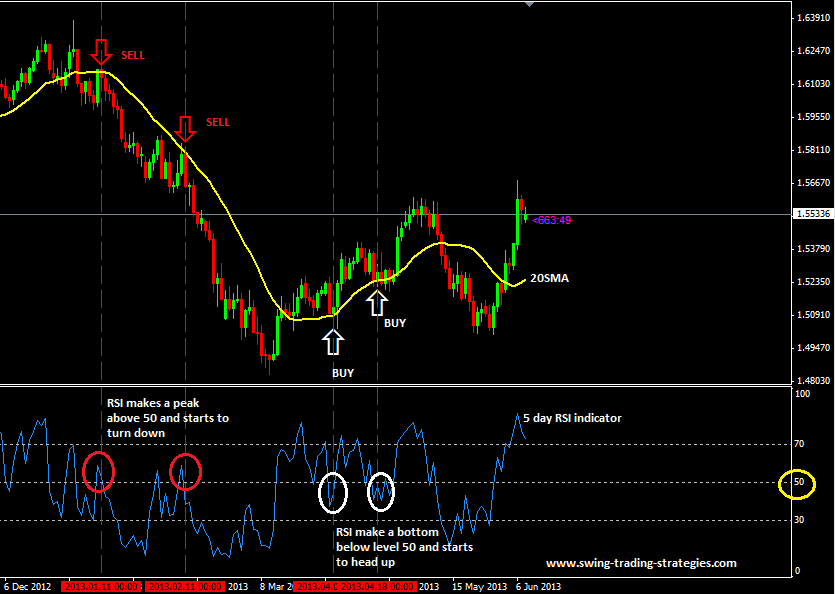

The RSI settings should be set to 5 days RSI and we are going to use the “50” level for this strategy. The standard look back period is 14 and by using 5 days, we will be able to take advantage of increased momentum sooner.

The purpose of the RSI in this trading strategy is to confirm the strength of the trend:

- When the RSI peaks above the 50 level and starts to turn down, it indicates that the uptrend (or minor rally) is weakening and it is a good time to be looking to go short

- When the RSI bottoms below the 50 level and starts to head up, it indicates that the downtrend (or minor pullback) may be weakening and it may be a good time to look for a trade entry signal to go long

Note that we will not be using bullish divergence, bearish divergence or the overbought and oversold levels. We are going to keep this trading strategy simple.

Sell Signal Rules of RSI Trading Strategy

The chart below will walk through the 5 steps that follow. We will be using the 20 SMA as our trading action zone:

- Price has to be below the 20 SMA -indicating a downtrend.

- Wait for price to rally back up to touch the 20 SMA line.

- Once 20 SMA line is touched, look down to see if the 5 day RSI has peaked above 50 level and has started to turn down-confirming a weakening upward momentum.

- Place a sell stop order under the low of the candlestick (after it closes). This candlestick should coincide with the RSI starting to turn down.

- Place Your stop loss above the high of that candlestick.

Your profit target: Ideally, you would like to see a 3R profit

Another option would be to exit with whatever profit you have when the opposite trading signal is given.

Also consider a trade management strategy of scaling out combined with a trailing stop.

Buy Signal Rules

Like many robust trading strategies, you can use this strategy for taking long and short trades. Here is how to setup and manage a buying opportunity when the buy trading signal appears:

- Price has to be above the 20 SMA – indicating an uptrend.

- Wait for price to pullback down to touch the 20 SMA line.

- Once 20 SMA line is touched, look down to see if the 5 day RSI has bottomed below 50 RSI level and has started to turn up-confirming a weakening downward momentum.

- The buy signal is active. Place a buy stop order above the high of the candlestick (after it closes). This candlestick should coincide with the RSI starting to turn up.

- Place Your stop loss below the high of that candlestick.

- Your profit target: 3 times what you risked. Another option would be to exit with whatever profit you have when the opposite trading signal is given (which is when a sell signal is given).

Advantages of this RSI Trading System

- Simple to learn and implement

- When a market gets on a good trending run, you can have one trade make your entire year

- Stops are well defined and gives no excuse to ignore this vital order

- Reward to risk ratio, although never guaranteed, can be quite incredible if using a trailing stop approach

The Disadvantages

- If you are not strict with your definition of a trend, you could find yourself trading in market that has no trending momentum

- You must learn the difference between climax price movement and natural price movement

- You must keep watch on the strength of any pullback. We do not want to see momentum in the prive movement during a pullback

- Moving averages lag so the trend may be well on its way before the 20 SMA catches up to price

HOW TO IMPROVE YOUR TRADE ENTRY TECHNIQUE

Here is one really effective way to improve your trade entry technique.

How?

Buy using reversal candlestick patterns and price action that form when the price touches the 20 SMA line. Look for reversal candlesticks like:

- Harami

- Engulfing pattern

- Dark Cloud Cover

- Evening Star Doji

- Shooting Star/Hammer.

Remember that all technical indicators such as the RSI and moving averages NEED price to happen first before it calculates. Knowing how to trade price action at the 20 SMA when the RSI lines up with a trade can get you into trades earlier.

Click this link for more information on reversal candlestick chart patterns.

Here is another RSI Trading System using a 5 period moving average.

Posted in

Posted in